Review

General Company Information

Alpha Capital Group has established itself as a leading player in the competitive world of global proprietary trading. The company is dedicated to providing a broad community of traders with the tools and environment necessary to thrive in the financial markets.

Its core mission is to provide a community of over 100,000 monthly active analysts with exceptional trading conditions. These conditions are complemented by cutting-edge analytical tools and customer service that strives for excellence.

History and Growth

Since its founding in November 2021 by traders George Kohler and Andrew Blaylock, Alpha Capital Group has grown rapidly.

In March 2022, they completed their technology and launched services to the public, adding their first client. A month later, they introduced ACG Markets, their in-house broker licensed by Metaquotes, further integrating their trading infrastructure.

In November 2023, ACG Markets obtained the Seychelles FSA license as a deposit-based broker. In December, they gave away 75,000 accounts, and their app surpassed 250,000 users.

In 2024, they expanded their offering with cTrader and DX Trade, and in June, they launched Alpha Futures. Performance fee payments reached $70 million in October. In the fourth quarter, they launched Alpha One and Alpha One X, along with a brand refresh.

By 2025, they plan to launch Alpha Trader and Alpha TV, showcasing their long-term vision and commitment to innovation.

Management Team

Alpha Capital Group’s management team is comprised of professionals with extensive experience in the financial sector. George Kohler, Managing Director and Founder, brings a solid foundation in banking, finance, and investments.

Andrew Blaylock, Co-Founder and Director, has nearly two decades of experience in financial services and founded his own brokerage, giving him a unique perspective on traders’ needs. Blaylock is an advocate for rapid support and transparency within the industry.

In addition to his role at Alpha Capital, Andrew Blaylock is a Fellow of the Chartered Institute for Securities & Investment (MCSI) and holds a Level 6 Certificate in Private Investment Advice and Management (PCIAM). His career includes over 15 years of experience in equities, beginning at Hoodless Brennan and subsequently at Central Markets, where he also advised on equities. Following the acquisition of Central Markets, Blaylock became a founding director of Clear Capital, where he currently oversees the brokerage desk.

Completing the management team are Alexander ‘Alex’, Head of Business Development, with experience in financial sales and collaboration with equity and derivatives brokers, and Jonathan ‘Planty’, Chief Market Analyst, who brings nearly three decades of experience in financial markets.

Group Structure

The Alpha Capital Group structure encompasses several specialized entities that contribute to its overall mission.

- Alpha Capital: Is the leading prop firm, focused on leveraging traders’ analytical skills to develop data-driven strategies.

- Alpha Futures: Takes proprietary futures trading to the next level, offering a platform with advanced in-house technology to generate accurate and impactful analysis. In the future, Alpha Futures plans to integrate TradingView, Tradovate, and NinjaTrader, demonstrating its commitment to expanding its trading ecosystem.

- ACG Markets: Is the group’s regulated broker, licensed in the Seychelles. It provides a secure and compliant environment for market participants, offering competitive access to global markets. This entity is licensed by the Financial Services Authority (FSA) in Seychelles.

Alpha Pro

The Alpha Pro plan is the standard 2-step evaluation. It allows traders to select a Phase 1 profit target of 8% or 10% at checkout. The Phase 2 profit target is set at 5%.

This plan has a static maximum drawdown of 10% and a maximum daily drawdown based on the balance of 5%. A minimum of 3 trading days is required for each evaluation phase.

Traders who opt for the Alpha Pro plan can access leverage of up to 1:100 on Forex, 1:30 on metals, 1:20 on indices, and 1:10 on oil. An important feature is the ability to hold trades over the weekend during the evaluation phases, although this option is not available for Qualified Analyst accounts.

Regarding news trading, the Alpha Pro plan imposes a 2-minute restriction window before and after the release of relevant news.

Alpha Swing

The Alpha Swing plan is specifically designed for traders who prefer longer-term strategies. This plan offers a 10% profit target for Phase 1 and a 5% profit target for Phase 2.

It features a static maximum drawdown of 10% and a maximum daily drawdown based on the balance of 5%, with a minimum trading period of 3 days required for each phase. Leverage is offered at 1:30 for Forex, 1:9 for metals, and 1:10 for both indices and oil.

One of the advantages of this plan is that it allows swing traders to hold trades over the weekend at all stages, providing greater flexibility. News trading is permitted; however, if a trade is initiated within two minutes before or after a news release, its duration must exceed two minutes to be considered valid. It is important to note that Alpha Swing accounts are subject to specific rules against trading “gambling.”

Alpha One

The Alpha One plan is distinguished by being a single-step evaluation. It requires achieving a Phase 1 profit target of 10%.

The maximum drawdown on this plan is trailing and is set at 6% based on the account’s high-water mark. The maximum daily drawdown is 4% and is calculated based on the balance or equity, whichever is greater. The evaluation requires a minimum of just one trading day.

Regarding leverage, it offers up to 1:30 for Forex, 1:9 for metals, and 1:10 for indices and oil. Similar to the Swing plan, it allows you to hold trades over the weekend at all stages. News trading is permitted, although with a 5-minute restriction window before and after relevant news releases. A notable feature is the availability of on-demand performance fees.

Alpha Three

The Alpha Three plan features a 3-step evaluation structure. The profit targets are 8% for Phase 1, 4% for Phase 2, and 4% for Phase 3.

The maximum static drawdown is set at 6%, and the maximum daily drawdown is 4%, calculated on the balance or equity, whichever is greater. Each phase of the evaluation requires a minimum of 3 trading days.

Leverage ranges up to 1:50 for Forex, 1:9 for metals, and 1:10 for indices and oil. Like the Swing plan, it allows you to hold trades over the weekend at all stages. News trading is permitted with a 5-minute restriction window before and after the release.

Plan Comparison Table

To facilitate comparison between these plans, the following table summarizes their main features:

| Feature | Alpha Pro | Alpha Swing | Alpha One | Alpha Three |

|---|---|---|---|---|

| Phases | 2 | 2 | 1 | 3 |

| Target Benefit Phase 1 | 8% or 10% (optional) | 10% | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% | N/A | 4% |

| Objective Benefit Phase 3 | N/A | N/A | N/A | 4% |

| Maximum Drawdown | 10% (Static) | 10% (Static) | 6% (Trailing by High-Water Mark) | 6% (Static) |

| Maximum Daily Drawdown | 5% (Balance) | 5% (Balance) | 4% (Balance or Equity, whichever is greater) | 4% (Balance or Equity, whichever is greater) |

| Minimum Days | 3 per phase | 3 per phase | 1 (Evaluation) | 3 per phase |

| FX Leverage | 1:100 | 1:30 | 1:30 | 1:50 |

| Metals Leverage | 1:30 | 1:9 | 1:9 | 1:9 |

| Leverage Indices | 1:20 | 1:10 | 1:10 | 1:10 |

| Oil Leverage | 1:10 | 1:10 | 1:10 | 1:10 |

| Weekend Hold | Yes (Phase 1/2), No (Qualified Analyst) | Yes (All Stages) | Yes (All Stages) | Yes (All Stages) |

| Trading News | 2 min before/after restriction (Pro) | Allowed (duration > 2 min if opened close) | 5 min before/after restriction (One/Three) | 5 min before/after restriction (One/Three) |

Account Sizes and Prices

| Size | Alpha Pro 8% | Alpha Pro 10% | Alpha Swing | Alpha One | Alpha Three |

|---|---|---|---|---|---|

| $5K | $77 | $50 | $70 | $50 | - |

| $10K | $147 | $97 | $147 | $97 | $67 |

| $25K | $247 | $197 | $247 | $197 | $157 |

| $50K | $357 | $297 | $357 | $297 | $247 |

| $100K | $577 | $497 | $577 | $497 | $397 |

| $200K | $1097 | $997 | $1097 | $997 | $697 |

Scaling Plan

In addition to the starter plans, Alpha Capital Group offers a scaling plan for funded accounts in the Alpha Pro, Alpha Swing, and Alpha Three plans. This plan allows successful traders to increase their virtual capital up to a cumulative total of $2 million across all their scaled accounts.

To begin the scaling process, a trader must achieve 10% growth in their trading account and request scaling. The scaling amount will be equivalent to 10% of the initial account balance.

It’s important to note that to request a scale-up, the account must be in the cash-out stage and all profits must have been withdrawn, which will restore the account’s initial balance. Once a new scaled account is activated, a minimum of 5 trading days is required before the first Performance Fee can be applied.

On the first scale, there is no increase in the maximum lot size. However, on the second scale, the trader is eligible for a 10% increase in the maximum lot size.

Trading Rules

Maximum allocation

The maximum total allocation allowed per trader is $400,000. This amount is shared across all plans offered (Pro, Swing, One, and Three). The specific rules for each account type (targets, drawdown, minimum days, etc.) have already been detailed in the previous section.

Forbidden Strategies

Alpha Capital Group imposes restrictions on certain trading strategies. Strategies that seek to take advantage of unrealistic prices or erroneous trading opportunities are prohibited. This includes:

- Arbitration

- Latency Trading

- Front-running price feeds

- Exploitation of pricing errors

- High-frequency trading (HFT)

- Reverse trading or group hedging

- Order book spamming (mass placement of deceptive orders)

Additionally, third-party account management services are not permitted; all transactions must be executed by the account holder.

Using Expert Advisors (EAs)

Alpha Capital Group generally allows the use of Expert Advisors (EAs). However, HFT and latency arbitrage strategies are strictly prohibited.

Some users have reported negative experiences related to the use of EAs, including issues with payment denials. It’s important to note that for the free monthly trading competition, the use of EAs is explicitly prohibited.

Anti-Gambling Policy

Alpha Capital Group maintains a firm policy against “gambling” in trading, rejecting strategies that are considered “all or nothing.”

Gambling is considered to be behavior such as:

- Significant changes in batch size, especially during news events.

- Unusually short trading durations compared to the account average.

- Increased risk (larger lot size or wider stop loss) during news events.

- Very short-term speculative operations around high-impact news with no intention of holding positions long-term or following a consistent strategy.

The company believes that these types of transactions do not reflect a trader’s ability to manage risk, consistently achieve profits, and operate sustainably. Activity determined to be “gambling” will result in the elimination of any profits earned and may lead to the closure of the funded account and the termination of the contract.

Deposits and Withdrawals

Deposits

- Card

- Crypto

- Paypal

Withdrawals

For withdrawals of profits from a funded account, Alpha Capital Group offers several options:

- Bank transfer (WIRE, ACH, SWIFT)

- Payment platforms such as Rise and Wise.

It’s important to note that Alpha Capital Group does not facilitate cryptocurrency withdrawals due to a lack of regulatory oversight, which contravenes its compliance standards.

Processing Times

- Performance Fees: Usually 2 business days.

- Account Escalation: Approximately 24-48 business hours.

- First Performance Fee: A minimum of 5 days of trading with the same strategy is required.

- Withdrawal Frequency: Bi-weekly withdrawals are available (available 14 days after the first transaction). On-demand withdrawals are also available for some plans, subject to requirements (“40% Best Day” rule, 2% minimum gross profit).

Tradable Financial Instruments

Alpha Capital Group provides access to a variety of financial instruments:

- Forex: Wide selection of major, minor and exotic pairs.

- Metals: Gold (XAUUSD) and Silver (XAGUSD) are specifically mentioned. Trading in metals is permitted, with variable leverage depending on the plan.

- Indices: Trading in stock indices is permitted, with leverage depending on the plan. Cash Indices are also mentioned.

- Raw Materials: Oil stands out, with specific leverage according to the plan.

- Cryptocurrencies: Although ACG Markets may offer them, they are not explicitly mentioned as available for Alpha Capital Group standard evaluation or funded accounts.

Restricted Countries

Alpha Capital Group offers its services in more than 150 countries, but does not provide services to persons (nationals or residents) of the following countries: Afghanistan, Belarus, Burundi, Central African Republic, Chad, Democratic Republic of the Congo, Crimea, Eritrea, Iran, Iraq, Cuba, North Korea, Libya, Myanmar, Somalia, Sudan, Russia, Republic of South Sudan, Syria, Yemen, Venezuela and Vietnam. In addition, services are restricted in the sanctioned areas of Ukraine: Donetsk, Luhansk, Crimea, Kherson, and Zaporizhzhia.

Customer Support

Contact Channels

Alpha Capital Group offers multiple support channels:

- General Email: Info@alphacapitalgroup.uk

- Live Chat: Available on the website (slower response on weekends).

- Discord: Active server for the community.

- Help Center (FAQ): Detailed section on their website.

- No contact phone number is specified.

Availability

The customer support team is available Monday to Friday, 8 am to 8 pm (GMT). Email support operates during the same hours on weekdays. Live chat and Discord responses may be delayed on weekends.

Technical Aspects of Operations

Trading Platforms

Alpha Capital Group offers access to several robust platforms:

- MetaTrader 5 (MT5): Successor to MT4, ideal for sophisticated trading, with improved charting tools, more order types, and market depth. Available for Windows, macOS, Android, web, and iOS.

- cTrader: Known for its intuitive interface and powerful charts, it offers fast execution and advanced features. Available for Windows, macOS, Android, and the web.

- DX Trade: Geared toward institutional needs, with deep liquidity, advanced order types, and support for custom workflows and HFT. Available online.

- Alpha Trader: A proprietary platform in development, designed with unique features. It will integrate algorithmic tools, advanced TradingView charts, and a customizable interface. Its launch is expected soon.

Associate Broker: ACG Markets

The partner broker is ACG Markets, licensed and regulated in Seychelles. ACG Markets seeks to provide an institutional trading environment with real liquidity, market depth, and targeted execution speeds of less than 70 ms (even targeting less than 30 ms). MT5, cTrader, and DX Trade are accessible through ACG Markets.

They offer tight spreads, no hidden fees, and 24/5 support. Their raw spreads start from 0.1 pips.

Leverage, Commissions and Spreads

- Leverage: Varies by instrument and account type (detailed in the plans section).

- Commissions:

- Standard Account: No commissions on any asset class.

- RAW Account: $2.5 per lot charge per direction on Forex and Metals.

- Indexes: Commission-free on both accounts.

- Spreads: ACG Markets offers tight spreads, with raw spreads starting from 0.1 pips. The Pro plan offers both raw and standard spreads. For reference (IC Markets), average EUR/USD spreads start from 0.06 pips (Raw) and 0.86 pips (Standard).

Slippage

Alpha Capital Group, through ACG Markets, seeks to minimize slippage in execution. However, slippage is a common phenomenon influenced by volatility and liquidity. Some users report favorable conditions with tight spreads and fast execution without significant slippage issues.

Trademate and Account Metrics

Trademate

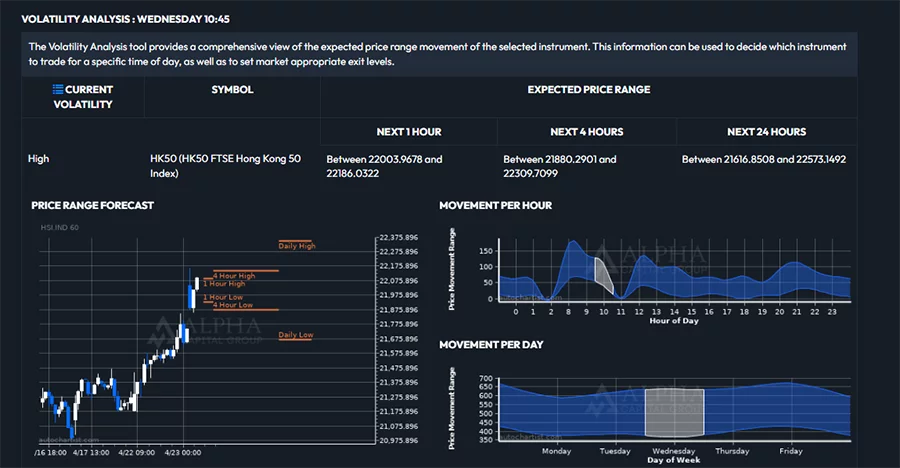

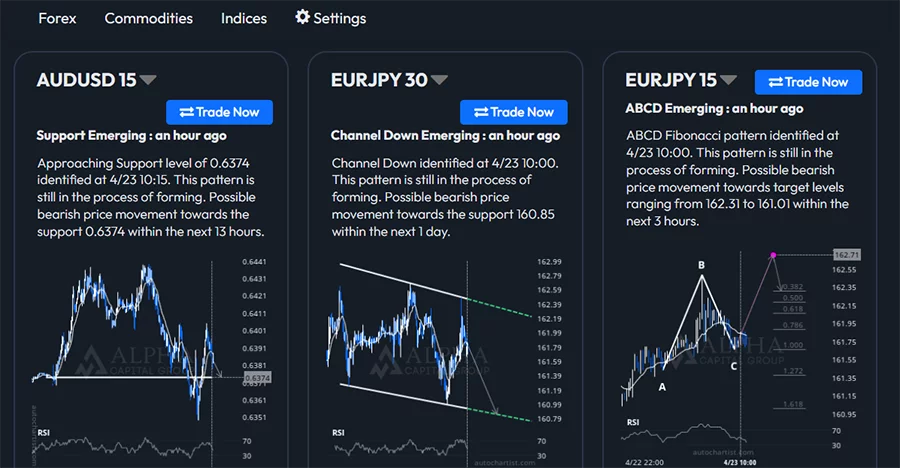

Trademate is a feature integrated into Alpha Capital Group’s Trader’s Dashboard. It provides valuable resources such as:

- Automated market scanners to identify opportunities.

- Complete economic calendar to follow macroeconomic events.

- Customizable market news reports and Twitter feeds for real-time tracking.

- Daily market reports (UK, US, Asian sessions) and integrated TradingView charts for in-depth analysis.

Dashboard Metrics

The Trader’s Dashboard offers a wide range of metrics for monitoring performance and managing risk. It allows you to:

- Track progress toward goals and risk parameters using balance, equity, profit, and drawdown charts.

- Risk exposure assessment with specific charts for lot size and number of open trades.

- Analysis of the effectiveness of strategies with key statistics such as win rate and risk-reward ratios.

- Clear display of important dates: start/end date for evaluations, and first trade date for funded accounts (relevant for payouts).

Monitoring Rules and Objectives

Through the dashboard, traders can easily monitor their trading rules and goals. The platform provides analytics and tracking features specific to the account and each individual trade. This helps assess performance against the requirements for passing the assessment and obtaining a funded account.

ACGMarkets: The Alpha Capital Group Broker

Introduction and Regulation

ACG Markets presents itself as the trading and analytics platform of Alpha Capital Group, acting as a key partner. It is regulated by the Seychelles Financial Services Authority (FSA) (license SD182). It was launched in April 2022. The CEO of Alpha Capital Group aims for ACG Markets to position itself among the best brokers in the industry.

Trading Conditions

ACG Markets offers specific conditions for Alpha Capital traders:

- Target order execution less than 30 milliseconds,

- Raw spreads from 0.1 pips.

- Commission-free trading on the Standard account.

Overall, it seeks to provide an institutional-like experience, with access to deep liquidity and efficient execution.

Interviews with Alpha Capital Traders

Purpose and Content

Alpha Capital Group values sharing the experiences of its successful traders. It regularly publishes interviews on its website and YouTube channel. The goal is to offer insight into the proven strategies and knowledge that have driven success, serving as inspiration and guidance.

These interviews also celebrate the achievements of community analysts, highlighting their milestones and dedication. There’s an opportunity to be interviewed by Words of Rizdom for analysts with inspiring stories.

Topics cover specific strategies, trading styles, risk management, and personal journeys.

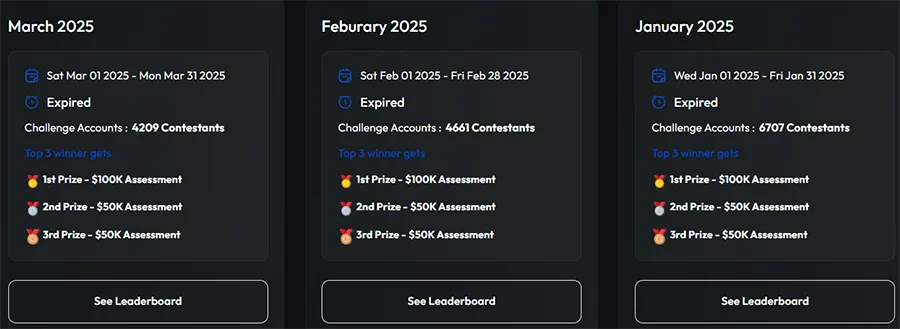

Monthly Trading Competitions

Description and Rules

Alpha Capital Group organizes free monthly trading competitions. They allow you to demonstrate your skills and compete with no entry fee (one entry per person).

Rules for equity are established:

- The use of Expert Advisors (EAs) is prohibited.

- Lot size limits: max. 10 lots (FX, Gold, Silver), max. 30 lots (Oil, CFDs, Indices).

- Maximum 5 consecutive open operations.

- Maximum daily drawdown of 5% and maximum total drawdown of 10%.

Holding positions over the weekend and trading during the news is allowed (following the Swing Plan guidelines). The winner is determined by the highest net profit in dollars.

Awards

Prizes for top performers include account evaluations of varying sizes, up to a $100,000 evaluation for first place.

Alpha Capital Group’s strengths

- Various Plans: A varied selection of financing plans tailored to different styles and risks.

- Internally Regulated Broker: ACG Markets can offer benefits in execution and conditions.

- Advanced Platforms: Access to MT5, cTrader, DX Trade and the upcoming Alpha Trader with TradingView.

- Competitive Conditions: Tight spreads and commission-free option (Standard account).

- Scaling Plan: Opportunity to significantly increase the capital allocated to profitable traders.

- Flexible Withdrawals: Bi-weekly and on-demand options (with requirements).

- Community and Support: Active community and support accessible through multiple channels.

- Educational Resources: Interviews with successful traders as a source of learning.

- Free Competitions: Opportunity to test the platform and win funding at no cost.

- Overall Focus: There seems to be a focus on transparency and trader support.

Final Opinion

Alpha Capital Group presents itself as a prop firm with a solid offering in the proprietary trading market. The variety of plans, the regulated in-house broker, the advanced platforms, and the competitive conditions are strong points. The scaling plan and flexible withdrawal options add value.

The company seems committed to its community and trader support, as evidenced by its customer service channels and published interviews. Free monthly competitions are an added incentive.

However, potential traders should conduct their own due diligence. Regulation in Seychelles is a point to consider. Although the majority opinions seem positive, it is prudent to consider third-party reports about potential issues. The anti-gambling policy is crucial and should be well understood.

In conclusion, Alpha Capital Group could be a suitable option for many traders, especially those who value platform variety, competitive conditions, and the opportunity for growth through scaling. It is recommended to carefully review the rules of each plan to ensure they fit your individual strategies and preferences.

Don't miss anything!

Get the latest news, exclusive promotions and funded trading analysis directly in your inbox