Review

General Company Information

Founded in 2012, Audacity Capital is a prop trading firm with a distinguished track record in the financial industry. Since its inception, it has cultivated a significant global presence, operating in over 146 countries and building a community of over 150,000 traders. The firm stands out with a monthly payout volume exceeding $3.2 million, reflecting its market activity.

Delving into its offering, the firm offers highly attractive features such as profit sharing of up to 90% and the ability to scale accounts up to $2 million. It also highlights the flexibility of its Ability Challenge program, which allows for the use of EAs and trading during news events.

Funded Trader Program

This program offers direct access to a funded live account, with no demo evaluation. It is designed for experienced traders looking to trade with real capital immediately. The elimination of the evaluation attracts confident traders looking to generate real profits quickly. For profitable traders with a proven track record, the evaluation may seem unnecessary. Immediate funding allows strategies to be applied directly in the live market.

Capital and Scaling Options

Within the Funded Trader Program, you can choose between initial capital of $7.5k, $15k, and $60k. From day one, you have access to Forex, indices, and gold. It offers an attractive scaling plan that allows you to increase your capital up to $2 million by meeting profit targets. The potential to scale to such a significant amount is a strong incentive for ambitious traders. This plan rewards consistent profitability and offers the opportunity to manage substantial capital, increasing your profit potential.

Profit Sharing and Payments

Profit sharing can reach up to 90%, one of the most competitive offerings. Payments are made biweekly, providing a more regular income stream than monthly payments. A 90% share is very attractive and can be decisive. A higher share means the trader retains more of their profits. Payment frequency is also important for financial management.

Trading Rules

Certain rules must be followed:

- Minimum of 5 trading days.

- At least 3 profitable days within those 5 days.

- Maximum daily loss of 5% (trailing).

- Maximum absolute drawdown of 10% (no trailing).

- 10% profit target to double the account.

These rules define risk limits and performance requirements. The 5% trailing daily drawdown is calculated from the daily peak and can be more restrictive. The 10% absolute drawdown provides a clear total loss limit. The 3-day profit requirement underscores the importance of consistency.

Restrictions

An important restriction is the prohibition on trading during major economic news. This is a common risk management measure, as volatility increases during news events, increasing the risk of losses. Movements can be rapid and unpredictable, driven by speculation. By prohibiting trading during these periods, Audacity Capital seeks to protect traders and their capital from extreme volatility.

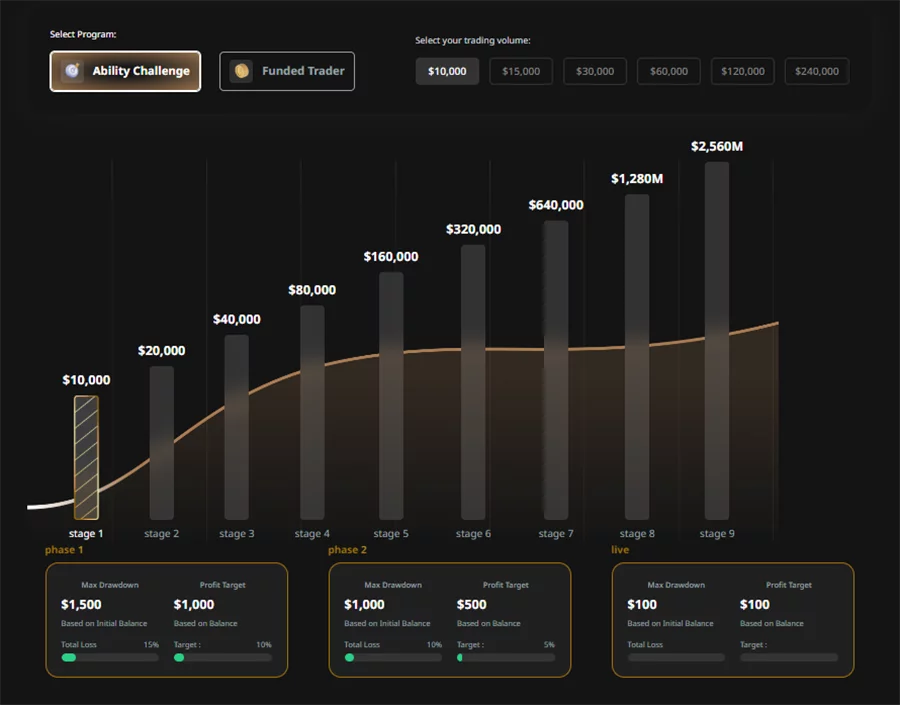

Ability Challenge

The Ability Challenge offers funding through a two-phase evaluation on a demo account.

Evaluation Phases

- Phase 1 (Challenge):

- Profit target: 10%.

- Maximum daily drawdown: 7.5%.

- Absolute maximum drawdown: 15%.

- Minimum trading days: 4.

- Phase 2 (Verification): (After passing Phase 1)

- Profit target: 5%.

- Maximum daily drawdown: 5%.

- Absolute maximum drawdown: 10%.

- Minimum trading days: 4.

Reducing targets and drawdown in Phase 2 suggests a focus on confirming consistency and risk management. Phase 1 identifies traders with potential; Phase 2 verifies that profits weren’t luck and that the trader is managing risk appropriately.

Funded Account and Profit Sharing

Upon completion of both phases, a funded real account is obtained. Profit sharing can reach up to 85% if criteria are met (standard 75%). Payments are biweekly. Participation is somewhat lower than that of the Funded Trader Program (up to 90%), perhaps reflecting access via evaluation. The possibility of increasing to 85% based on performance is an additional incentive. Prop firms often offer different participation structures depending on the funding path. Programs with evaluation may offer a lower initial stake, with the possibility of increasing it based on performance.

Flexibility in Strategies

A significant advantage is the flexibility in permitted strategies. Unlike the Funded Trader Program, the following are permitted:

- Use of Expert Advisors (EAs).

- Trading during economic news.

- Keep operations open during the night and weekends.

This flexibility appeals to a wider range of traders. The inclusion of EAs is advantageous for automated traders. Trading during the news allows you to take advantage of volatility. Holding positions over the weekend provides flexibility for swing strategies.

Account Sizes, Fees and Leverage

Account sizes and one-time fees are:

- $10k: £129

- $15k: £149

- $30k: £269

- $60k: £369

- $120k: £629

- $240k: £926.50 (according to external discounted source)

Leverage is 1:100. Some external sources provide slightly different details (e.g., target 10% in both phases, total drawdown 10%), which differs from the official information. This underscores the importance of always checking with the official source.

Fare Refund

An additional benefit is that the participation fee is refunded to traders who pass the evaluation and obtain a funded account. This reduces the initial cost for successful traders and makes the program more attractive. The refund aligns the interests of the trader and the firm. If the trader is successful, they essentially trade with free company capital (apart from profit sharing).

General Trading Rules

The rules vary between the two main programs.

Funded Trader Program

- Minimum 5 days of trading, with at least 3 profitable days.

- Maximum daily loss: 5% (trailing).

- Maximum absolute drawdown: 10% (no trailing).

- 10% profit target to double account.

- Trading prohibited during important economic news.

- It is not specified whether night/weekend operations are permitted, although past accounts suggest otherwise.

Ability Challenge

- Minimum 4 days of trading in each phase.

- Maximum daily drawdown: 7.5% (Phase 1), 5% (Phase 2).

- Absolute maximum drawdown: 15% (Phase 1), 10% (Phase 2).

- Profit objective: 10% (Phase 1), 5% (Phase 2).

- Trading allowed during the news and holding night/weekend trades.

Common Rules and Verification

- For both programs, the use of Martingale strategy is prohibited.

- They may require KYC (Know Your Customer) verification and comply with AML (Anti-Money Laundering) regulations, although this is not explicitly stated. These are industry standards for security and legality.

Account Sizes and Prices

Ability Challenge

The following table details the account sizes and prices for the Ability Challenge:

| Account Size | GBP | USD | EUR |

|---|---|---|---|

| $10k | £70 | $90 | €86 |

| $15k | £105 | $130 | €126 |

| $30k | £185 | $230 | €226 |

| $60k | £250 | $320 | €306 |

| $120k | £430 | $540 | €520 |

| $240k | £865 | €1090 | €1046 |

Funded Trader Program

| Account Size | GBP | USD | EUR |

|---|---|---|---|

| $7.5k | £260 | $329 | €305 |

| $15k | £520 | $649 | €605 |

| $60k | £1915 | $2399 | €2240 |

Technical Aspects

Trading Platforms

- Metatrader 5

Broker and Execution

- Institutional liquidity providers

Leverage

- Ability Challenge: 1:100.

- Funded Trader Program: 1:30.

Commissions

- Forex: $3/lot

- Metals: $5/lot

- Indices: $1/lot

Deposits and Withdrawals

Deposit Methods

- Bank transfer

- Crypto

Withdrawal Methods

- Card

- Paypal

- Transfer

- Crypto

Restricted Countries

Starting in February 2024, they implemented a temporary suspension of new US client registrations. This was done to align services with regulatory standards in that jurisdiction. It only affected new registrations, not existing US traders.

Customer Support

They provide several means of contact:

- Direct telephone: +44 20 8050 1985.

- Email for inquiries and support: support@audacity.capital.

Audacity Capital’s Strengths

- Antiquity and Reputation: Founded in 2012.

- High Profit Sharing: Up to 90%.

- Scaling Potential: Up to $2 million.

- Liquidity and Spreads: Access to institutional liquidity, spreads promoted as premium.

- Fast Payments: Processing in 2-4 days, bi-weekly frequency.

- Variety of Programs: Ability Challenge (assessment) and Funded Trader Program (direct).

- Flexibility (Ability Challenge): Allows EAs, news trading.

- Fee Refund (Ability Challenge): For those who pass the evaluation.

- Free Trial

- Positive Testimonials: They suggest clear rules, good execution, adequate support.

- Platforms: MT5

Don't miss anything!

Get the latest news, exclusive promotions and funded trading analysis directly in your inbox