Review

General Company Information

FTMO is a prop trading firm founded in 2015 with the aim of discovering and supporting talent in the trading world. Since its inception, it has focused its business model on a two-phase evaluation process: the FTMO Challenge and the Verification. Both stages are designed to measure applicants’ ability to manage risk and achieve sustained profitability.

This firm was founded in a context of booming online trading and the development of financial technologies. As a result, FTMO adopted a digital approach from the outset, supported by technological innovation to provide modern and efficient services.

FTMO seeks to establish itself as an investment firm with a global presence, serving as a bridge between retail traders and investors. Its vision includes creating an international community of successful traders who can eventually attract institutional investment, thus generating new opportunities within the FTMO ecosystem.

History

FTMO’s origins date back to a small group of traders in Prague who shared ideas about risk management and strategies. The project, initially called Ziskejucet.cz, grew and went international in 2017 under the name FTMO.com.

This approach, based on the experience of real traders, explains its emphasis on training and support as central parts of its offering.

Awards and Recognitions

FTMO has received multiple awards:

-

Finance Magnates London Summit (2023 and 2024): Best Prop-Trading Firm/Provider

-

Deloitte Fast 50: Fastest-growing tech company in Central Europe (2023)

-

EY Entrepreneur Of The Year (2022): Recognition of founders

-

Forbes (2024): Highlighted its 25% revenue growth

These awards reinforce their prestige within the prop trading industry.

The Evaluation Process

FTMO Challenge

The FTMO Challenge is the first stage of the evaluation process. It involves a demo account with real-world market conditions (spreads, commissions, swaps, trading hours) where the trader must achieve certain goals without a time limit:

-

Profit Target: 10% of the initial balance

-

Maximum daily loss: 5%

-

Maximum total loss: 10%

-

Minimum trading days: 4

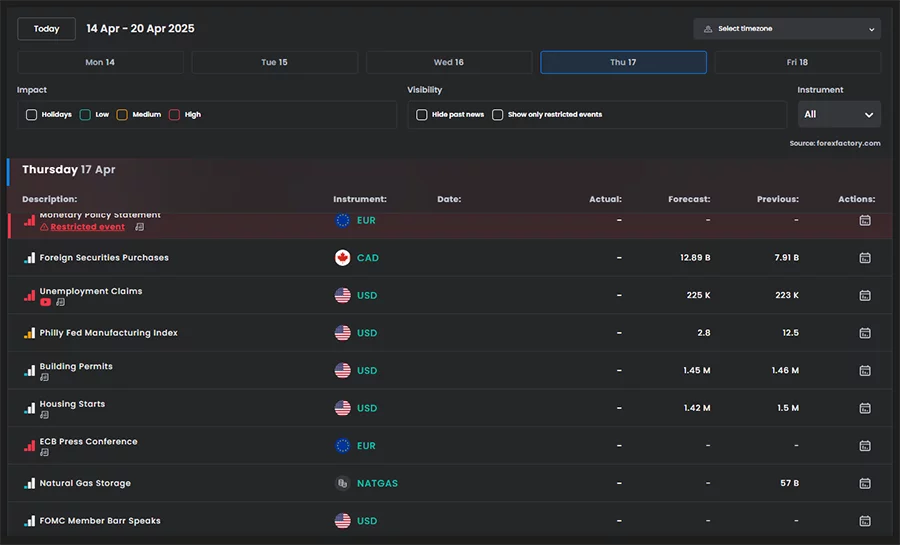

Holding open positions overnight and on weekends is permitted. It is also recommended to avoid trading during high-impact macroeconomic news.

Verification

The second phase maintains the same conditions as the Challenge with one key difference: the profit target is reduced to 5%. This stage seeks to confirm that previous performance was not the result of chance or risky trading.

Below is a comparative table of both phases:

| Objective / Rule | FTMO Challenge | Verification |

|---|---|---|

| Profit Target | 10% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Total Loss | 10% | 10% |

| Minimum Trading Days | 4 | 4 |

| Time Limit | Unlimited | Unlimited |

| Hold Positions O/N | Yes | Yes |

| Trading on News | Not recommended | Not recommended |

Trading Accounts

FTMO Account (Standard)

Once both stages are completed, the trader accesses the FTMO Account, which, although a demo account, offers the possibility of capturing up to 90% of the profits generated. This account has no profit target or minimum trading days, but it does maintain the maximum daily and total loss rules.

Additionally, FTMO reimburses the Challenge fee on your first earnings withdrawal. It also offers access to Performance Coaching and the FTMO Premium program.

Available Account Types and Sizes

Below are the account sizes by type and currency:

Normal Account

| Size | USD | EUR | GBP | CHF | CZK |

|---|---|---|---|---|---|

| Basic | 10,000 | 10,000 | 10,000 | 10,000 | 250,000 |

| Medium | 25,000 | 20,000 | 20,000 | 20,000 | 500,000 |

| Advanced | 50,000 | 40,000 | 40,000 | 40,000 | 1,000,000 |

| Pro | 100,000 | 80,000 | 80,000 | 80,000 | 2,000,000 |

| Elite | 200,000 | 160,000 | 160,000 | 160,000 | 4,000,000 |

Countdown

| Size | USD | EUR | GBP | CHF | CZK |

|---|---|---|---|---|---|

| Basic | 15,000 | 15,000 | 15,000 | 15,000 | 375,000 |

| Medium | 30,000 | 30,000 | 30,000 | 30,000 | 750,000 |

| Advanced | 60,000 | 60,000 | 60,000 | 60,000 | 1,500,000 |

| Pro | 120,000 | 120,000 | 120,000 | 120,000 | 3,000,000 |

Swing FTMO Account

Designed for traders who trade on higher time frames or use fundamental analysis. It allows you to hold open positions on weekends and during newscasts, but the leverage is lower:

-

Forex: 1:30

-

Indexes: 1:15 (1:9 in some)

-

Metals: 1:9

-

Cryptos, stocks and commodities: 1:1

Costs and Fees

FTMO Challenge Rates

The cost of the Challenge varies depending on the account size. Below is a guideline table in euros:

| Account Size | Price (EUR) |

|---|---|

| $10,000 | €155 |

| $25,000 | €250 |

| $50,000 | €345 |

| $100,000 | €540 |

| $200,000 | €1,080 |

These fees are refunded to the trader once they pass the evaluation and make their first withdrawal from the funded account.

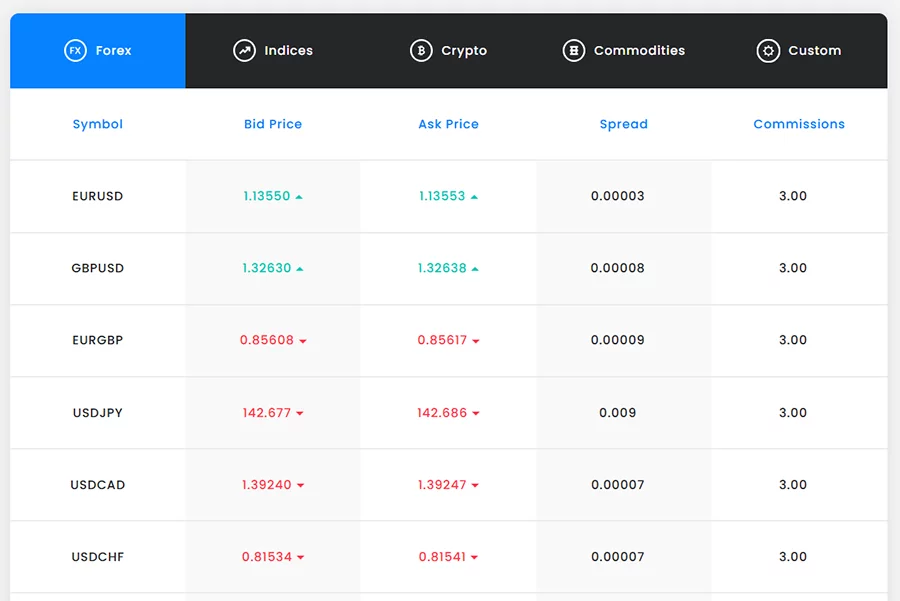

Instrument Fees

| Instrument | Commission |

|---|---|

| Forex | $3 USD per round lot |

| US Stock CFDs | 0.0040% per lot |

| Metals (XAU, XAG, etc.) | 0.0010% per lot |

| Indices | Commission-free |

| Cryptocurrencies | Commission-free |

| CFDs on futures | Commission-free |

Trading Rules

During the Evaluation Process

Traders must follow strict rules during the Challenge and Verification. The following are required:

-

Meeting profit and loss targets

-

Minimum trading days

-

Do not exploit platform errors or deceptive practices

The use of Expert Advisors is permitted, provided they operate with coherent and realistic logic. FTMO allows connections via VPS or VPN, except from US IP addresses.

Once Anchored

In the funded account, only the maximum daily and total losses are met. There is no profit target or minimum trading days. The standard account does not allow open positions on weekends, and trading during major news events is discouraged.

In contrast, the FTMO Swing account allows greater freedom to leave positions open or act on news, ideal for long-term strategies or those based on fundamental analysis.

Deposits and Withdrawals

Payment Methods

FTMO accepts multiple payment methods to access the Challenge:

-

Cards (Visa, Mastercard)

-

Bank transfer (not available in certain countries)

-

PayPal, Skrill and cryptocurrencies (3% commission)

Withdrawals of Earnings

Once funded, it can be withdrawn through:

-

Bank transfer

-

Skrill

-

Cryptocurrencies (BTC, ETH, LTC, USDT, USDC)

Withdrawals take between 1 and 2 business days and are free of charge from FTMO. A minimum of $20 is required for transfers and $50 for cryptocurrencies.

Available Financial Instruments

FTMO allows trading in a wide range of assets:

-

Forex (major, minor and exotic pairs)

-

Stock market indices

-

Cryptocurrencies

-

Raw materials (gold, oil, etc.)

-

CFDs on shares

This variety allows traders to apply strategies in markets they are familiar with or that suit their style.

Customer Support

FTMO offers 24/7 multi-channel support:

-

Live Chat and WhatsApp

-

Email support@ftmo.com

-

Phone: +420 910 920 310 (Monday to Friday, 9am to 5pm CET)

Support is available in 18 languages, including Spanish, English, French, Portuguese, Vietnamese, Arabic, and more.

Technical Aspects

Available Platforms

FTMO allows you to operate with:

-

MetaTrader 4 (MT4)

-

MetaTrader 5 (MT5)

-

cTrader

-

DXtrade

The accounts are demo accounts, but the data comes from real liquidity providers, with spreads and conditions that simulate the real market. The maximum leverage is:

-

Standard: up to 1:100

-

Swing: reduced to 1:30 (Forex) and less for other assets

Don't miss anything!

Get the latest news, exclusive promotions and funded trading analysis directly in your inbox