Earn money by buying funding accounts

Get back 4% of your purchase price from Funded Trading Plus

Stackable with other promotions

Earn money by buying funding accounts

Get back 4% of your purchase price from Funded Trading Plus

Stackable with other promotions

Review

General Company Information

Funded Trading Plus presents itself as a reliable firm within the funded capital trading sector. They offer traders the opportunity to manage simulated funds with the possibility of receiving real capital payments, potentially in as little as one day.

The company emphasizes its promise of five-star customer service. This commitment is reflected in competitive program pricing, secure payments, fair and transparent rules, a responsive user experience, and 24/7 technical support.

History, Innovation and Mission

Founded in 2021, Funded Trading Plus was a pioneer in offering unlimited time-based evaluations, a feature that has become common in the industry.

This innovative vision has been complemented by the creation of a wide selection of programs, including one- and two-phase models, as well as instant financing options. This reflects an effort to adapt to the diverse needs of traders.

The company’s genesis is based on years of experience and research by industry experts, with the fundamental objective of democratizing access to trading capital for talented traders.

Origins and Experience

To better understand its proposition, Funded Trading Plus can be considered an evolution of Trade Room Plus, a prominent UK live trading room that has been active since 2013.

This connection suggests a solid foundation in understanding market dynamics and the needs of retail traders. They recognize a common challenge: the lack of sufficient capital to generate significant returns, even with good management.

Program and Evaluation Structure

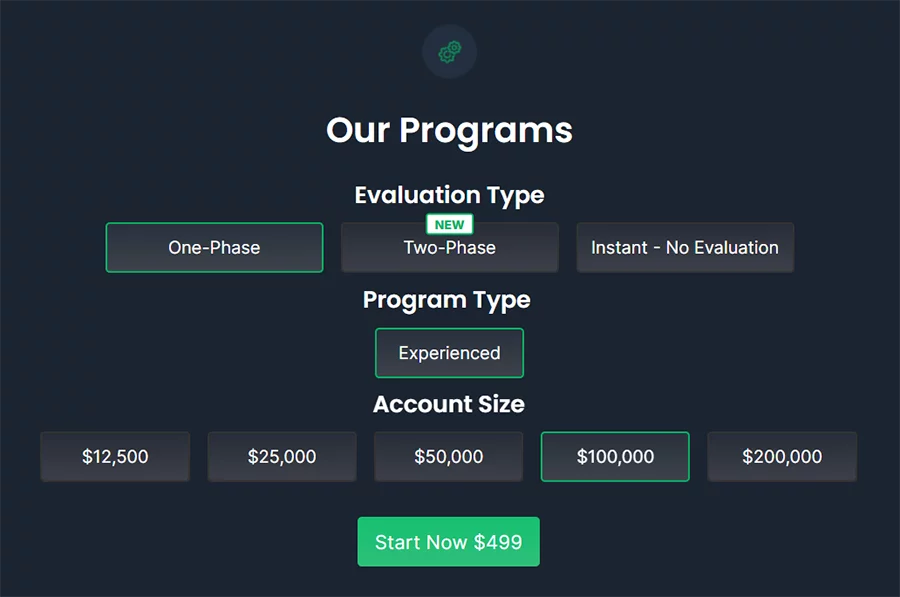

Funded Trading Plus organizes its offering into several types of accounts, classified by programs and evaluation methodologies.

Types of Evaluation

- One Phase: Single-stage evaluation process.

- Two Phases: Evaluation model in two different stages.

- New Instant - No Evaluation: Allows you to trade with simulated funds immediately, skipping the evaluation.

Additionally, the platform offers different program levels: Prestige Trader, Experienced Trader, Advanced Trader, Premium Trader, and Master Trader. This structure aims to offer customized solutions based on the trader’s experience and preferences.

The “FT+ Trader” phase designates the stage following successful completion of the assessment in programs that require it, indicating a common framework.

Prestige Trader Program

Main Features and Structure

The Prestige Program is a two-stage assessment account with a static drawdown model. This means the maximum loss limit remains fixed relative to the initial balance, providing predictability in risk management.

Trading Objectives and Requirements

Profit targets are 10% of initial capital in Phase 1 and an additional 5% in Phase 2. Both phases require a minimum of three profitable trading days, with a minimum daily profit of 0.5% of the account balance. These days do not need to be consecutive, allowing for flexibility.

Trading Conditions

The Prestige Program allows you to hold open positions over the weekend and does not require the use of stop losses, which can benefit longer-term strategies.

Funded Trading Plus imposes no time limits for completing evaluations or trading FT+ Trader accounts. The only requirement is to keep the account active with at least one simulated trade every 30 calendar days.

Escalation Plan

The scaling plan for this program has a 20% profit target to request a capital increase.

To do so, traders must meet several requirements: reach the minimum number of profitable days, have made at least one withdrawal from their FT+ Trader account, maintain an active account for at least two months, have the required 20% profit in their closed balance upon request, and generate a new 20% at the current level to move up. This policy emphasizes the need for sustained profitability and responsible management over time.

The Prestige Program’s static drawdown provides a clear loss barrier. The scaling requirements (consistent profitability, prior withdrawal, minimal activity) suggest a focus on rewarding long-term consistency and responsible management. The two-month activity requirement for scaling implies a longer-term perspective.

Account Size Summary

Below is a comparative table of account sizes for the Prestige Trader Program. Please visit the Funded Trading Plus website for specific fees.

| Account Size | Phase 1 Profit Target | Phase 2 Profit Target | Maximum Drawdown | Daily Loss Limit | Minimum Profitable Days | Fee |

|---|---|---|---|---|---|---|

| $50,000 | 10% ($5,000) | 5% ($2,500) | 10% ($5,000) | 5% ($2,500) | 3 days at 0.5% | N/A |

| $100,000 | 10% ($10,000) | 5% ($5,000) | 10% ($10,000) | 5% ($5,000) | 3 days at 0.5% | N/A |

| $200,000 | 10% ($20,000) | 5% ($10,000) | 10% ($20,000) | 5% ($10,000) | 3 days at 0.5% | N/A |

Experienced Trader Program

Main Features and Evaluation

The Experienced Trader Program is designed for experienced traders and features a single-stage assessment (FT+ Trader stage). It seeks to identify skilled traders under realistic simulated conditions.

Objectives and Risk Management

The simulated profit target is 10% of the initial capital. This target must be achieved without exceeding a simulated maximum loss of 6% of the initial balance (relative drawdown) or a simulated daily loss exceeding 4% of the previous day’s balance.

Trading Conditions

There is no limit on the number of simulated trading days to complete the evaluation, allowing you to trade without the pressure of strict deadlines. However, one simulated trade is required every 30 calendar days to keep the account active. There is no minimum number of trading days required to pass.

Regarding the rules, no simulated stop loss is required, holding trades over the weekend is permitted, and non-arbitrary Expert Advisors (EAs) are used. The maximum simulated leverage is 30:1.

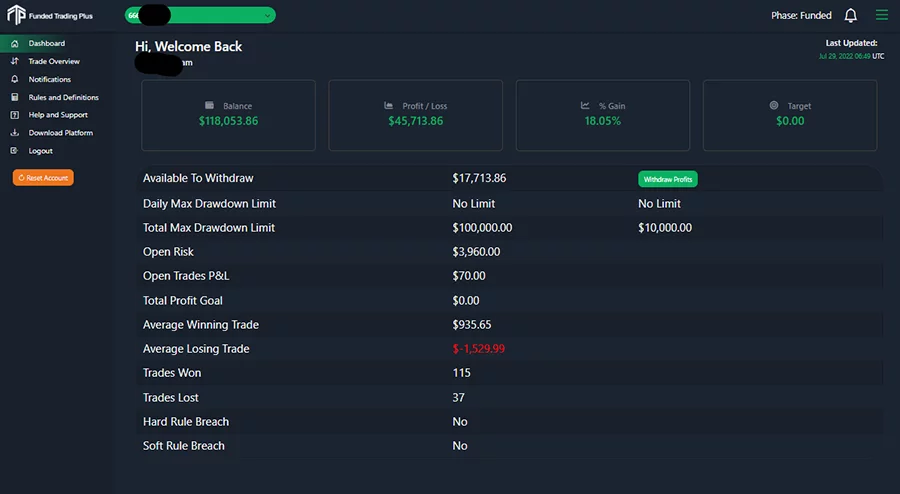

Profit Distribution and Withdrawals

Upon entering the FT+ Trader phase, you start with an 80/20 simulated profit split (80% to the trader). This percentage can increase to 90/10 upon reaching 20% simulated profit, and to 100/0 upon reaching 30%.

Withdrawals of simulated profits can be requested from the first day of the FT+ Trader phase, and then every 7 calendar days thereafter. The minimum is $50, with no additional fees from FT+ (except banking/conversion fees).

Escalation and Refund Plan The program features a scaling plan: you can request an increase to the next simulated account level for every 10% of simulated profit achieved in your FT+ Trader account.

It offers the ability to manage up to $5,000,000 in initial simulated funds (with the Enhanced Scaling Add-on). The initial fee is refundable upon reaching a 10% simulated profit.

Unique Feature: Drawdown Lock

An important feature: Upon reaching a positive closing balance of 6% in the FT+ Trader account, the simulated maximum loss is no longer considered a trailing loss. The total simulated account balance becomes the new minimum loss.

The Experienced Trader Program stands out for its straightforward evaluation, unlimited time limits, and attractive scaling plan. The possibility of early withdrawals and fee reimbursement are advantages. The relative drawdown offers flexibility, and its 6% profit lock adds security.

Account Size Summary

Comparative table of account sizes for the Experienced Trader Program. See the Funded Trading Plus website for fees.

| Account Size | Profit Target | Maximum Drawdown | Daily Loss Limit | Fee |

|---|---|---|---|---|

| $25,000 | 10% ($2,500) | 6% ($1,500) | 4% ($1,000) | N/A |

| $50,000 | 10% ($5,000) | 6% ($3,000) | 4% ($2,000) | N/A |

| $100,000 | 10% ($10,000) | 6% ($6,000) | 4% ($4,000) | N/A |

| $200,000 | 10% ($20,000) | 6% ($12,000) | 4% ($8,000) | N/A |

Advanced Trader Program

Evaluation Structure

The Advanced Trader Program is a two-phase evaluation option. Phase 1 requires a 10% profit, and Phase 2 requires a 5% profit.

Limits and General Conditions

Like other FT+ programs, it imposes no time limits and offers 1:30 leverage. However, it stands out with stricter drawdown limits: 10% total maximum and 5% daily.

Specific Trading Rules

A key rule is the requirement to use a stop-loss on every trade. Furthermore, holding open positions over the weekend is not permitted, which can affect strategies.

Escalation Plan

The scaling plan sets a 20% profit target for requesting a capital increase in the funded account.

The Advanced Trader Program, with its two-phase evaluation and tight drawdown limits, may be suitable for traders who prefer a rigorous structure and are comfortable with the mandatory stop-loss and weekend restriction. The 20% scalping target is also distinctive.

Account Size Summary

Comparative table of Advanced Trader Program account sizes. See the Funded Trading Plus website for fees.

| Account Size | Phase 1 Profit Target | Phase 2 Profit Target | Maximum Drawdown | Daily Loss Limit | Fee |

|---|---|---|---|---|---|

| $25,000 | 10% ($2,500) | 5% ($1,250) | 10% ($2,500) | 5% ($1,250) | N/A |

| $50,000 | 10% ($5,000) | 5% ($2,500) | 10% ($5,000) | 5% ($2,500) | N/A |

| $100,000 | 10% ($10,000) | 5% ($5,000) | 10% ($10,000) | 5% ($5,000) | N/A |

| $200,000 | 10% ($20,000) | 5% ($10,000) | 10% ($20,000) | 5% ($10,000) | N/A |

Premium Trader Program

Evaluation Approach and Structure

The Premium Trader Program is structured in two evaluation phases leading to the FT+ Trader account. It aims to offer flexibility and favorable conditions, especially for traders who use smart money concepts.

Objectives and Risk Management

Phase 1 requires a simulated profit target of 8%, and phase 2 requires a 5% target, always within the drawdown limits.

This program operates with a maximum relative drawdown and trailing drawdown of 8%, and a daily trailing loss limit of 4%. It seeks to balance risk and flexibility.

Benefit Withdrawals

Once in the FT+ Trader demo account, the first withdrawal can be requested seven days after activation. The minimum is $50, and subsequent requests are made every seven days.

Trading Rules and Conditions

The rules are: target 8% (phase 1) and 5% (phase 2), maximum relative drawdown 8%, daily drawdown 4%. It allows trading overnight/weekend and does not require the use of stop losses.

Escalation Plan

The Scaling Plan allows you to increase account equity by 10% for every 10% simulated profit in your FT+ Trader account, up to a potential $2.5 million.

To apply, you must: reach the closed balance target, have no open trades, have the required profit on your closed balance, and achieve a new 10% profit at your current level. All applications are subject to risk review.

The Premium Trader Program, with its lower initial targets, flexible drawdown, and significant scaling, seems designed for traders seeking a balanced risk/reward. The flexibility with weekend trading and stop losses can be advantageous. Its focus on “smart money” suggests an affinity with advanced strategies.

Account Size Summary

Comparative table of Premium Trader Program account sizes. See the Funded Trading Plus website for rates.

| Account Size | Phase 1 Profit Target | Phase 2 Profit Target | Maximum Drawdown | Daily Loss Limit | Fee |

|---|---|---|---|---|---|

| $25,000 | 8% ($2,000) | 5% ($1,250) | 8% Relative Trailing | 4% Trailing | N/A |

| $50,000 | 8% ($4,000) | 5% ($2,500) | 8% Relative Trailing | 4% Trailing | N/A |

| $100,000 | 8% ($8,000) | 5% ($5,000) | 8% Relative Trailing | 4% Trailing | N/A |

| $200,000 | 8% ($16,000) | 5% ($10,000) | 8% Relative Trailing | 4% Trailing | N/A |

Master Trader Program (Instant Funding)

Key Features: Instant Financing

The Master Trader Program offers instant funding, eliminating the evaluation phase. It is designed for traders who want to start trading and earn potential profits immediately.

Objective and Risk Management

Set a simulated profit target of 5%. Risk management uses a simulated trailing drawdown of 5%, which adjusts based on the highest balance point.

Operating Rules (Weekend)

A specific rule is not to keep trades open over the weekend. They are automatically closed on Fridays at 9:30 PM GMT (4:30 PM EST). However, this rule is flexible, and breaking it does not close the account.

Other Trading Conditions

It does not require simulated stop losses and allows for EAs (see FAQ for details). The maximum simulated lot size depends on the available margin. The maximum simulated leverage is 30:1, which varies depending on the asset.

Profit Distribution and Withdrawals

Traders start with a simulated 80/20 profit split. Withdrawals can be requested from day one, then every 7 calendar days thereafter. The minimum is $50, with no additional fees from FT+ (except banking/conversion fees).

Escalation Plan

It offers a scaling plan to manage up to $5,000,000 simulated. It can be requested daily upon reaching a 10% simulated profit in the ‘FT+ Trader’ account. It’s important to note that scaling increases simulated buying power, but not drawdown.

Unique Feature: Elimination of Drawdown Trailing

Once the simulated profit target of 5% is reached, the trailing aspect of the 5% drawdown is eliminated. The initial balance becomes the minimum loss point.

The Master Trader Program offers a direct route to trading with significant simulated capital, attractive to experienced traders looking to scale profits quickly. Initial trailing drawdown requires careful management, but its elimination upon reaching the target provides stability. The weekend restriction is an important consideration for longer-term strategies.

Account Size Summary

Comparative table of Master Trader Program account sizes. See the Funded Trading Plus website for fees.

| Account Size | Profit Target | Maximum Drawdown | Daily Loss Limit | Fee |

|---|---|---|---|---|

| $25,000 | 5% ($1,250) | 5% Trailing | Implied Drawdown | N/A |

| $50,000 | 5% ($2,500) | 5% Trailing | Implied Drawdown | N/A |

| $100,000 | 5% ($5,000) | 5% Trailing | Implied Drawdown | N/A |

| $200,000 | 5% ($10,000) | 5% Trailing | Implied Drawdown | N/A |

Available trading instruments

Funded Trading Plus offers access to a wide range of trading instruments within its live simulated environment, covering Forex, index markets, commodities, and an extensive selection of cryptocurrencies. Traders can view the full list of tradable assets on their website via this link.

The company stands out for providing access to more than 250 cryptocurrency pairs, in addition to traditional currency pairs, indices, and commodities. This diverse offering allows traders to apply their strategies to a variety of markets.

Below is a table listing the trading instruments offered by Funded Trading Plus, categorized by type, according to information available on their website.

| Category | Symbols |

|---|---|

| Forex Majors & Minors | AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY |

| Forex Exotics | AUDSGD, CADSGD, EURMXN, EURNOK, EURSEK, EURSGD, EURTRY, GBPNOK, GBPSDG, GBPSEK, GBPTRY, MXNJPY, NOKSEK, NZDCNH, NZDSGD, SGDJPY, USDCNH, USDDKK, USDHKD, USDMXN, USDNOK, USDSEK, USDSGD, USDTRY, USDZAR |

| Spot Metals | XAUUSD, XAGUSD |

| Commodities | BRENT, WTI |

| Indices | ESTX50, FRA40, GER40, UK100, SPAIN35, JPN225, NAS100, SPX500, US30 |

| Cryptos | BCHUSD, BTCUSD, ETHUSD, LTCUSD |

Rules

Restrictions on trading styles

Funded Trading Plus generally adopts a flexible stance regarding permitted trading styles. The company is open to a wide variety of strategies, including those based on “smart money” concepts and scalping. Its philosophy appears to be permissive, as indicated by the phrase “If it’s not cheating, we allow it.”

However, there is one important restriction: Traders cannot take opposing positions on more than one account, either during the evaluation phase or as an FT+ Trader. This practice is considered a form of cheating and can result in account closure without reimbursement. This rule aims to prevent abuse of the system and ensure fairness among all participants.

Funded Trading Plus’s openness to diverse trading styles allows a wider range of traders to participate in its programs, as strict limitations on specific methodologies are not imposed. The prohibition on taking opposing positions across multiple accounts is a standard measure in the prop firm industry to maintain the integrity of the trading environment.

Policy on the use of Expert Advisors (EAs)

Funded Trading Plus explicitly allows the use of Expert Advisors (EAs) in its programs. This policy is favorable for traders who prefer to automate their trading strategies. However, there is one important condition: The EAs used must not employ arbitrage methods. Arbitrage, which seeks to exploit price differences between different markets or brokers, is generally considered an unfair practice in the context of prop firms.

Funded Trading Plus suggests that the MetaTrader 4 (MT4) platform may be more suitable for EA users due to its extensive third-party development, which means greater availability of tools and resources compatible with automated trading. For more specific details on the EA usage policy, please refer to the website’s FAQ section.

The permissiveness toward the use of EAs makes Funded Trading Plus an attractive option for traders who rely on automation to execute their strategies. The restriction on arbitrage seeks to maintain fairness and prevent practices that could give an unfair advantage to some participants.

Regulations on the possibility of keeping operations open during the weekend

In general, Funded Trading Plus allows traders to keep trades open over the weekend in most of its programs. This flexibility is beneficial for swing traders and those who are unable or unwilling to close their positions at the end of the trading week.

It’s important to note that the Master Trader Program (Instant Funding) is an exception to this rule. In this specific program, simulated trades are automatically closed on Fridays at 9:30 PM GMT (4:30 PM EST). This is considered a flexible rule, and failure to comply with this rule will not result in account closure.

The ability to hold trades over the weekend in most Funded Trading Plus programs provides greater flexibility for traders with longer-term strategies. The exception for the Master Trader Program is likely related to the nature of instant funding and specific risk management considerations for that program.

Stop Loss Requirements

Funded Trading Plus does not require the mandatory use of stop losses in its programs. This policy gives traders the freedom to manage their trades and risk according to their own strategies and preferences. The absence of a stop loss requirement can be advantageous for experienced traders who employ alternative methods to limit their losses and protect their capital.

The lack of mandatory stop losses gives traders more control over their positions and is suitable for strategies that may not rely on fixed stop losses. This flexibility is particularly useful for experienced traders who have their own risk management protocols.

Details on the leverage offered

The maximum simulated leverage offered by Funded Trading Plus in its programs is 30:1. It’s important to note that specific leverage may vary depending on the simulated asset class being traded. For example, the leverage for currency pairs may be different from that offered for indices or commodities.

Leverage of 30:1 allows traders to control positions significantly larger than their simulated capital, which can amplify both potential profits and losses. The potential for varying leverage by asset is a common industry practice to manage the risk associated with the volatility of different markets.

Other rules

In addition to the rules mentioned above, Funded Trading Plus imposes a 30-calendar-day account activity requirement. This means that traders must make at least one simulated trade within a 30-day period to keep their account active. This rule ensures that accounts are actively used and prevents them from remaining inactive for extended periods.

Funded Trading Plus operates under live simulated conditions for all its clients, at all stages of all its programs. This means traders trade using real market data, but with virtual funds.

Finally, the platform allows both long and short positions in the same market simultaneously. However, traders cannot take opposing positions in more than one account (either during the evaluation or as an FT+ Trader). This practice is considered a form of cheating and may result in account closure without the right to a refund. This rule is designed to prevent platform abuse and ensure fair play for all users.

The 30-day activity requirement ensures that accounts are actively used. The “live simulated” option guarantees a realistic trading experience. The prohibition on opposing positions across multiple accounts is a standard anti-abuse measure.

Account Escalation Plan

Funded Trading Plus’s scale-in plans offer the ability to manage significant capital as traders demonstrate profitability. Frequency and requirements vary between programs, with the Experienced and Master Trader programs offering the ability to scale more frequently. The Prestige Program imposes stricter requirements, while the Advanced Trader program has a 20% profit target for scale-in. All programs emphasize the need to achieve specific profit targets and are subject to a risk review before approving scale-in.

Below is a comparative table of the scaling plan for each program, based on available information.

| Program | Scaling Profit Requirement | Scaling Frequency | Maximum Achievable Capital | Additional Requirements |

|---|---|---|---|---|

| Experienced Trader | 10% | Up to once per day | $5,000,000 | Enhanced Scaling Add-on Purchase |

| Prestige Trader | 20% | Every 20% profit | Not specified | Minimum profitable days, prior withdrawal, 2 months of activity |

| Advanced Trader | 20% | Not specified | Not specified | Not specified |

| Premium Trader | 10% | Every 10% profit | $2,500,000 | Not specified |

| Master Trader | 10% | Up to once a day | $5,000,000 | Not specified |

Experienced Trader Program

Traders can request to scale their account for every 10% of simulated profit they achieve in the FT+ Trader phase. This program offers the possibility of reaching simulated capital of up to $5,000,000, subject to the purchase of an Enhanced Scaling Add-on. Scaling increases buying power, but not drawdown, and all requests are subject to a risk review. Traders can request to scale up to once per day.

Prestige Trader Program

Scaling can be requested every 20% of simulated profit in the FT+ Trader phase. Scaling requirements include reaching the minimum profitable days with the established minimum profit, making at least one withdrawal, having an active account for at least two months, having the required 20% profit in the closed balance, and having generated a new 20% profit at the current level. “Skipping” levels is not permitted, and all requests are subject to risk review.

Advanced Trader Program

The program sets a 20% profit target to scale the funded account. No additional details are provided regarding the frequency or specific increases in available shards.

Premium Trader Program

Traders can scale their account for every 10% of profit achieved, with the potential to reach up to $2.5 million. Scale-in requires the FT+ Trader account’s closed balance to reach the target, no open trades, the required 10% profit on the closed balance, and a 10% new profit generated at the current tier. Tier skipping is not permitted, and all requests are subject to risk review.

Master Trader Program

This program offers a scaling plan that allows traders to manage up to $5,000,000 in simulated funds. Scaling can be requested daily after achieving a simulated profit of 10% in the FT+ Trader account. Scaling increases buying power, not drawdown.

Supported Trading Platforms

Funded Trading Plus offers its traders the ability to trade across three main platforms, each with its own features and advantages.

TradingView

This platform has gained great popularity among traders due to the wealth of detailed information it offers on a wide range of tradable assets. Many traders find its charting tools and social media features provide a significant advantage in the markets.

TradingView’s integration with the Eightcap broker allows Funded Trading Plus users to access this powerful platform. TradingView’s growing popularity and intuitive interface make it an attractive option for many traders.

MT5

MetaTrader 5 (MT5) is recognized as one of the most widely used trading platforms worldwide, especially among Forex traders. MT5’s versatility and broad support for different asset classes make it a robust option for a variety of trading strategies.

MT4

MetaTrader 4 (MT4) was developed specifically for the forex market. Although its cryptocurrency support isn’t as extensive as MT5’s, MT4 remains extremely popular among traders due to its numerous third-party developments, including a wide range of custom indicators and Expert Advisors (EAs).

Funded Trading Plus suggests that MT4 could be the preferred choice for traders looking to use EAs. MT4’s long history and extensive user community make it a familiar and trusted platform for many Forex traders.

Brokers

Funded Trading Plus partners with renowned brokers such as Eightcap and ThinkMarkets, offering clients the option to choose between them when purchasing a program. The company also emphasizes the competitiveness of its spreads and the quality of its trade execution.

Funded Trading Plus recently announced the availability of MT4 and MT5 for non-US clients, signaling a commitment to continually improving its offering and expanding the options available to its users.

Community and Trader Support

Funded Trading Plus recognizes the importance of building a strong community and providing high-quality customer support to its traders.

Discord Community

The company maintains an active Discord server. This serves as a hub for customers to receive quick assistance from the support team and interact with other Funded Trading Plus traders.

The Funded Trading Plus Discord community has over 20,000 active members, demonstrating a high level of engagement and user satisfaction.

This platform allows for the exchange of trading knowledge, discussion of strategies, and updates on the latest market trends. This creates a collaborative and supportive environment for traders around the world.

Blog

Funded Trading Plus also offers a blog accessible through the navigation menu under “About Us.” The blog, titled “The Funded Trader,” contains articles, analysis, and other educational resources.

Additionally, the company produces a podcast called “We Are Funded Trading Plus.” This podcast has received praise for its transparency and informative content, contributing to Funded Trading Plus’s reputation as a trustworthy, trader-focused firm.

Customer Support

Funded Trading Plus is committed to providing 24/7 customer support. This commitment is reflected in its 5-Star Promise, which underscores the company’s dedication to providing an exceptional experience.

User reviews often highlight the responsiveness and helpfulness of the support team, with specific mentions of the proactivity and attentiveness of people like Simon Massey.

Traders appreciate the availability of multiple contact methods, including live chat, a ticketing system, and a phone number (+44 333 090 9800) visible in the website footer.

The reliability and responsiveness of support staff are consistently praised by the trading community.

Company Information

Funded Trading Plus (FT+) has its roots in the UK and emerged as an extension of Trade Room Plus, a leading live trading room for retail traders that has been operating for over a decade.

The company was founded in 2021 with the mission of empowering talented traders by providing them with tools and access to significant investor capital. Simon Paul Massey is the owner, and the company has been active in funding since 2021, although its educational division dates back to 2013.

Legally, FTP Ltd (number 2025-00109) is registered as an International Business Company (IBC) in Saint Lucia, although its registered office is at Suite A, 82 James Carter Road, Mildenhall, Bury St. Edmunds, UK, IP28 7DE.

Contact Information

Funded Trading Plus offers multiple ways to contact us. The “Contact Us” section is accessible from the main menu and the footer. They offer “Live Chat” and “New Ticket” options for direct inquiries.

The phone number is +44 333 090 9800 (also in the footer). For job opportunities, please contact work@nomadsurfers.com.

Funded Trading Plus’s track record, starting with Trade Room Plus, suggests industry expertise. Registration and location information provides legal and operational transparency. The availability of multiple contact channels demonstrates a customer-centric approach.

Trader Testimonials

Funded Trading Plus has received positive reviews, suggesting overall satisfaction with its services. The company has a high rating on TrustPilot (4.9 out of 5 based on more than 1,300 verified reviews), indicating strong loyalty and a positive experience.

Comments on his podcast also highlight his commitment to quality, building trust, transparency, flexibility, and overall excellence.

These testimonials and ratings can serve as an indicator of the reliability and quality of Funded Trading Plus services.

Promotions and Giveaways

Funded Trading Plus occasionally offers promotions and discounts. You are encouraged to follow the company’s social media channels to stay up-to-date on the latest promotions. These offers can make the programs more accessible.

Relevant Legal Information

Funded Trading Plus provides several important legal documents on its website.

Their Privacy Policy details how they collect, use, and store personal data, emphasizing privacy protection. Users can manage marketing preferences and limit data collection. It also provides information on the use of cookies.

The Terms and Conditions set forth the rules for using the services, including the conditions for participating in the programs.

The Refund Policy describes the conditions for requesting refunds, generally within 14 days if the operation has not been performed.

The Disclaimers section warns about the risks of trading and clarifies that the information on the site is for educational purposes only and may not be accurate.

Finally, the Cookie Policy explains the use of cookies and tracking technologies.

Withdrawal Process

Funded Trading Plus emphasizes the speed and frequency of its payouts. Traders in the “FT+ Trader” phase can withdraw part of their simulated profits as real funds, potentially on the same day.

Withdrawals can be made weekly, with a minimum of $50 and no additional fees from the company (excluding bank/conversion fees).

Funded Trading Plus also offers withdrawal options in cryptocurrencies such as Bitcoin, Ethereum, Tether, USD Coin, and Binance Pay.

The ease and variety of withdrawal methods are important aspects when evaluating a prop firm.

The presence of positive testimonials, promotions, detailed legal documents, and an efficient withdrawal process contribute to Funded Trading Plus’s value proposition. These elements can positively influence traders’ decisions.

Strengths of Funded Trading Plus

-

Funded Trading Plus presents itself as a prop firm that seeks to establish relationships of trust through transparency, fair rules, and high-quality support.

-

Its wide range of programs (one-/two-stage evaluation, instant funding) demonstrates an attempt to adapt to diverse needs and experience levels.

-

*The scaling plans offered are attractive, with the ability to manage significant simulated capital by demonstrating profitability.

-

The availability of popular platforms (TradingView, MT5, MT4), along with trusted brokers and an emphasis on competitive spreads, contribute to a favorable environment.

-

The active Discord community and educational resources (blog, podcast) suggest a commitment to supporting and developing its traders. A positive reputation, reflected in reviews, strengthens its credibility.

-

In terms of trading rules, Funded Trading Plus is generally flexible, allowing for a variety of trading styles and the use of EAs (restricting arbitrage). The ability to hold trades over the weekend (in most programs) and the lack of mandatory stop losses offer greater strategic freedom.

-

The withdrawal process appears efficient and flexible, with weekly payouts, a low minimum, and cryptocurrency acceptance.

-

Transparency in legal policies (privacy, T&Cs, refunds, notices, cookies) provides information for informed decisions.

-

In short, Funded Trading Plus is positioned as a solid option for traders looking for program variety, flexible rules, competitive scaling, and a strong focus on support and community. Those interested should explore the details of each program to find the one that best aligns with their goals and strategies.

Don't miss anything!

Get the latest news, exclusive promotions and funded trading analysis directly in your inbox