Earn money by buying funding accounts

Get back 5% of your purchase price from FXIFY

Stackable with other promotions

Earn money by buying funding accounts

Get back 5% of your purchase price from FXIFY

Stackable with other promotions

Review

General Company Information

FXIFY has established itself in the competitive proprietary trading firm sector as an option that prioritizes flexibility and structural soundness. In a market often saturated with similar offerings, the firm seeks to differentiate itself through a wide range of funding programs and a value proposition centered on its broker infrastructure. Its rapid growth is a testament to its acceptance in the trading community, having paid out over $30 million to its traders through more than 200,000 withdrawal transactions.

The “Backed by a Broker” Philosophy

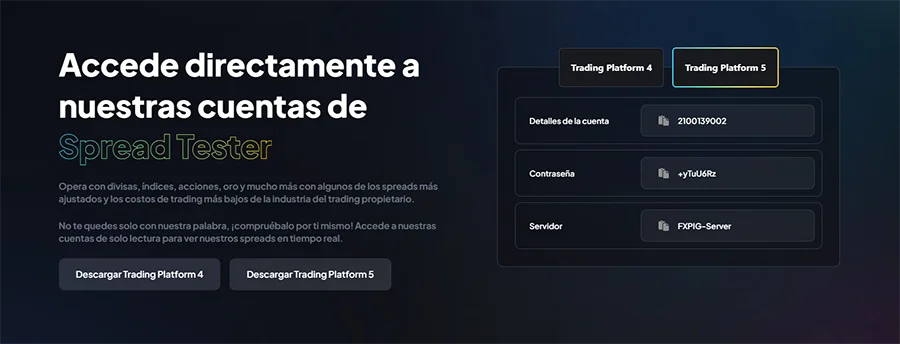

A fundamental pillar of FXIFY’s identity and marketing is its slogan “Built for Traders, Backed by a Broker”. The firm is part of a conglomerate of financial sector companies that includes the broker FXPIG, an entity with decades of experience in the foreign exchange market.

This vertical integration, according to FXIFY, gives them end-to-end control over the entire operation. Unlike other prop firms that may rely on partnerships with external brokers and be led by more marketing-oriented profiles, FXIFY claims that its brokerage experience allows them to guarantee superior trading conditions, reliable execution, and, most importantly, the security and speed of payouts.

However, this close relationship between the prop firm and the broker presents a duality that traders must consider. On one hand, the financial stability and operational experience of an established broker can offer greater security. On the other hand, this same integration could imply that risk management protocols are designed primarily to protect the broker’s capital. Rules like the “Withdrawal Drawdown Lock-in,” which will be discussed later, are aggressive risk management tactics that benefit the firm by limiting its exposure but can act to the detriment of traders if not fully understood.

Milestones and Key Figures

FXIFY’s performance metrics demonstrate a significant operational scale. The firm has served more than 180,000 traders in over 200 countries. In its first year of operations alone, FXIFY reported paying out over $8.7 million to its funded traders and facilitating a trading volume exceeding $1.7 trillion between evaluation and funded accounts. These figures not only underscore its legitimacy but also indicate a robust capacity to manage a large volume of trades and payouts.

Funding Programs: A Model for Every Trader

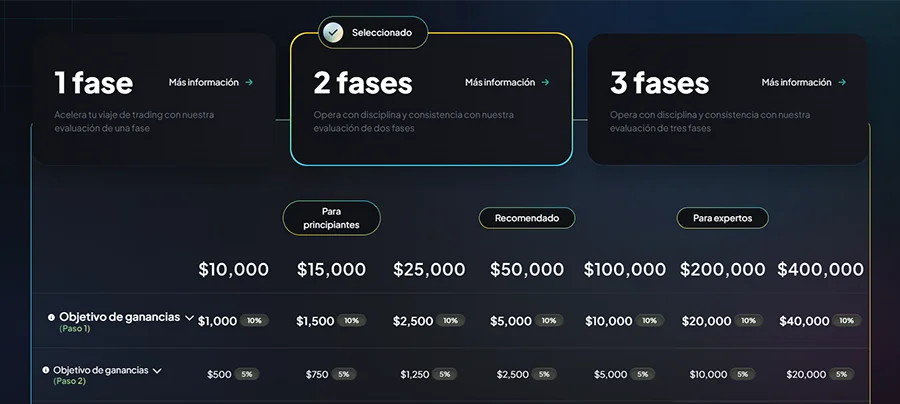

FXIFY’s most outstanding value proposition is its diversity of funding programs. The firm has structured its offering to suit virtually any trader profile, from the beginner who prefers a gradual approach to the experienced professional seeking immediate access to capital.

FXIFY offers five main funding models: the 1-Phase program, the 2-Phase program (with Classic and Standard variants), the 3-Phase program, Instant Funding, and the Lightning Challenge. Each of these programs has its own rules, objectives, and cost structure, designed to align with different trading styles, risk tolerances, and experience levels.

1-Phase Program: Quick Access to Capital

This program is designed for traders with a high degree of confidence in their strategy, who are looking for a direct and fast path to a funded account. By eliminating the second verification phase, the 1-Phase model allows qualified traders to access capital more quickly, albeit in exchange for a more demanding initial profit target.

Key Features and Rules

The core of the 1-Phase program is its simplicity. Traders must reach a 10% profit target without violating a 3% daily loss limit or a 6% maximum loss limit. One of the most significant advantages of this program is that it imposes no time limit to reach the profit target, which reduces psychological pressure and allows traders to wait for optimal market conditions for their strategy.

Accounts and Pricing Table: 1-Phase

| Account Size | Price (One-time Fee) | Profit Target (%) | Maximum Loss (%) | Daily Loss (%) |

|---|---|---|---|---|

| $5,000 | $59 | 10 | 6 | 3 |

| $10,000 | $89 | 10 | 6 | 3 |

| $15,000 | $119 | 10 | 6 | 3 |

| $25,000 | $199 | 10 | 6 | 3 |

| $50,000 | $379 | 10 | 6 | 3 |

| $100,000 | $549 | 10 | 6 | 3 |

| $200,000 | $1,049 | 10 | 6 | 3 |

| $400,000 | $2,950 | 10 | 6 | 3 |

2-Phase Program: Classic and Standard Options

The 2-Phase program is the most popular and recognized model in the industry, but FXIFY introduces additional flexibility by dividing it into two distinct variants: Classic (with static drawdown) and Standard (with trailing drawdown). Both options require a 25% consistency rate to obtain funding and operate on the MT4, MT5, and DXTrade platforms.

2-Phase Classic Program (EOD Static)

This variant is aimed at traders who prefer the clarity of a fixed loss limit. The drawdown is static, calculated on the initial balance, which means it does not move as profits are generated. The profit targets are structured inversely to the traditional model, with a lower target in the first phase. It offers a profit split of up to 100% without the need for add-ons, and payouts are made bi-weekly.

- Phase 1 (Challenge): 5% profit target.

- Phase 2 (Verification): 10% profit target.

- Risk limits: 4% maximum daily loss and 10% maximum total loss.

Accounts and Pricing Table: 2-Phase (Classic)

| Account Size | Price (One-time Fee) | Phase 1 Target (%) | Phase 2 Target (%) | Maximum Loss (Static) (%) | Daily Loss (%) |

|---|---|---|---|---|---|

| $5,000 | $59 | 5 | 10 | 10 | 4 |

| $10,000 | $89 | 5 | 10 | 10 | 4 |

| $15,000 | $119 | 5 | 10 | 10 | 4 |

| $25,000 | $199 | 5 | 10 | 10 | 4 |

| $50,000 | $379 | 5 | 10 | 10 | 4 |

| $100,000 | $549 | 5 | 10 | 10 | 4 |

2-Phase Standard Program (EOD Trailing)

This is the more traditional version of the two-phase challenge, with a higher profit target in the first stage. It uses a trailing drawdown, which means the maximum loss limit follows the profits earned. It offers a profit split of up to 90% and the option to request on-demand payouts if purchased at the start.

- Phase 1 (Challenge): 10% profit target.

- Phase 2 (Verification): 5% profit target.

- Risk limits: 4% maximum daily loss and 10% maximum total loss.

Accounts and Pricing Table: 2-Phase (Standard)

| Account Size | Price (One-time Fee) | Phase 1 Target (%) | Phase 2 Target (%) | Maximum Loss (Trailing) (%) | Daily Loss (%) |

|---|---|---|---|---|---|

| $5,000 | $59 | 10 | 5 | 10 | 4 |

| $10,000 | $89 | 10 | 5 | 10 | 4 |

| $15,000 | $119 | 10 | 5 | 10 | 4 |

| $25,000 | $199 | 10 | 5 | 10 | 4 |

| $50,000 | $379 | 10 | 5 | 10 | 4 |

| $100,000 | $549 | 10 | 5 | 10 | 4 |

| $200,000 | $1,049 | 10 | 5 | 10 | 4 |

| $400,000 | $2,950 | 10 | 5 | 10 | 4 |

3-Phase Program: Less Pressure, Same Goal

This program is the ideal option for traders who prefer a more methodical approach with less pressure. By dividing the evaluation process into three stages with lower profit targets and more affordable entry fees, the 3-Phase program is designed for those who value patience and gradual progress.

Key Features and Rules

The structure of this program significantly reduces psychological pressure. The trader must pass three consecutive stages, each with a 5% profit target. The risk limits are a 5% maximum loss and a 5% daily loss as well. This fragmentation of the total target makes each step more achievable, encouraging more conservative and consistent risk management.

Accounts and Pricing Table: 3-Phase

| Account Size | Price (One-time Fee) | Target per Phase (%) | Maximum Loss (%) | Daily Loss (%) |

|---|---|---|---|---|

| $5,000 | $39 | 5 | 5 | 5 |

| $10,000 | $59 | 5 | 5 | 5 |

| $15,000 | $79 | 5 | 5 | 5 |

| $25,000 | $149 | 5 | 5 | 5 |

| $50,000 | $249 | 5 | 5 | 5 |

| $100,000 | $399 | 5 | 5 | 5 |

| $200,000 | $799 | 5 | 5 | 5 |

| $400,000 | $1,599 | 5 | 5 | 5 |

Instant Funding: Trade Without Evaluation

The Instant Funding program is aimed exclusively at professional traders with a proven track record who do not wish or need to go through an evaluation process. This model offers immediate access to real capital, allowing traders to start generating profits from day one.

Key Features and Rules

The main advantage is the complete elimination of the evaluation phase. Traders purchase access to an account and can start trading with real funds immediately. There are no profit targets to meet. However, they operate under strict risk rules, including a maximum and daily drawdown of 8%. Payouts in this program are processed on a fixed 14-day cycle.

Accounts and Pricing Table: Instant Funding

| Account Size | Price (One-time Fee) | Maximum Loss (%) | Daily Loss (%) |

|---|---|---|---|

| $1,000 | $69 | 8 | 8 |

| $2,500 | $119 | 8 | 8 |

| $5,000 | $229 | 8 | 8 |

| $10,000 | $449 | 8 | 8 |

| $25,000 | $899 | 8 | 8 |

| $50,000 | $1,749 | 8 | 8 |

| $75,000 | $2,499 | 8 | 8 |

| $100,000 | $4,249 | 8 | 8 |

Lightning Challenge: For the Decisive Trader

The Lightning Challenge is a hybrid and accelerated program, designed for traders confident in their skills who are looking for the fastest and most affordable way to get funded. It is a high-risk, high-reward model that compresses the evaluation process into a short period of time.

Key Features and Rules

This challenge consists of a single evaluation phase with a 5% profit target, which must be reached within a maximum period of 7 days. The risk limits are very tight, with a 3% daily loss and a 4% maximum loss. A distinctive and crucial feature of this program is the application of a 30% consistency rule, which stipulates that the profits of a single day cannot exceed 30% of the total accumulated profit.

Accounts and Pricing Table: Lightning Challenge

| Account Size | Price (One-time Fee) | Profit Target (%) | Maximum Loss (%) | Daily Loss (%) |

|---|---|---|---|---|

| $10,000 | $59 | 5 | 4 | 3 |

| $25,000 | $119 | 5 | 4 | 3 |

| $50,000 | $209 | 5 | 4 | 3 |

| $100,000 | $399 | 5 | 4 | 3 |

General Comparative Table of Programs

To facilitate the choice of the most suitable program, the following table summarizes and compares the key features of the five funding models offered by FXIFY.

| Feature | 1-Phase | 2-Phase (Classic) | 2-Phase (Standard) | 3-Phase | Instant Funding | Lightning Challenge |

|---|---|---|---|---|---|---|

| Evaluation Phases | 1 | 2 | 2 | 3 | 0 | 1 |

| Profit Target | 10% | 5% and 10% | 10% and 5% | 5% per phase | N/A | 5% |

| Time Limit | Unlimited | Unlimited | Unlimited | Unlimited | N/A | 7 days |

| Drawdown Type | Trailing | Static | Trailing | Not specified | Static | Static |

| Consistency Rule | No | Yes (25%) | Yes (25%) | No | No | Yes (30%) |

| Initial Payout Frequency | On-demand | Bi-weekly | On-demand | On-demand | 14 days | On-demand |

| Ideal Trader Profile | Fast and confident | Standard and predictable | Disciplined and standard | Patient and methodical | Experienced professional | Fast and affordable |

Trading Rules: The Operational Parameters

Understanding FXIFY’s trading rules is fundamental, as they vary significantly between the different program types.

Use of Expert Advisors (EAs) and Copy Trading

FXIFY allows the use of Expert Advisors (EAs) in its evaluation programs (1, 2, and 3-Phase). However, their use is prohibited in Instant Funding and Lightning Challenge accounts. Additionally, EAs are not compatible with the DXtrade platform on any account.

Copy trading is allowed between different FXIFY accounts. To copy trades from an external source to an FXIFY account, the firm requires the submission of a trade history for approval.

Trading During News and Weekends

A notable advantage for traders in the evaluation programs (1, 2, and 3-Phase) is the freedom to trade during high-impact news events and to hold positions open over the weekend. This flexibility does not extend to Instant Funding accounts, which have a restriction that prohibits opening or closing trades in the 5 minutes before and after the release of relevant news.

Consistency Rules

There is an apparent contradiction in FXIFY’s communication about this rule. While its main page highlights “No Consistency Rules” as a general feature, a deeper analysis of the specific rules reveals important nuances. The 1 and 3-Phase evaluation programs effectively have no consistency rule. However, the Lightning Challenge does impose a strict 30% rule, and the 2-Phase programs require a 25% consistency rate. Furthermore, the firm’s futures division, FXIFY Futures, applies very rigorous consistency rules to its accounts.

Minimum Trading Days

To pass the evaluation phases, a minimum number of trading days is required. This is 5 days for the 1, 2, and 3-Phase programs, and 3 days for the Lightning Challenge. The Instant Funding program, having no evaluation, does not have this requirement.

Allowed Strategies

FXIFY shows remarkable flexibility by explicitly allowing strategies that many other firms prohibit, such as Martingale and Grid. While this may attract traders who use these methods, it is crucial to understand the calculation behind this permissiveness. These strategies, by their nature, exponentially increase risk and exposure. Combined with the firm’s strict drawdown limits, the probability of a trader using Martingale or Grid violating the rules is extremely high. Therefore, this “flexibility” can function as a risk filter for the firm itself, generating revenue from the failed attempts of traders who employ these high-risk strategies.

Deposits and Withdrawals: The Flow of Capital

The payment and withdrawal process is one of the most important aspects for any trader when evaluating a prop firm. FXIFY has designed a system with outstanding features, but also with a critical rule that requires maximum attention.

Payment Methods and Fees

To access any of the evaluation programs, a one-time, non-refundable fee must be paid. However, once the trader passes the evaluation and receives their first profit split from the funded account, FXIFY offers a 100% refund of this initial fee.

Profit Split

The standard profit split on all funded accounts is 80% for the trader. FXIFY offers the possibility to increase this share up to 90% by purchasing an “add-on” at the time of acquiring the account. The 2-Phase Classic program offers up to a 100% profit split without add-ons.

The “First On-Demand Payout”

This is one of FXIFY’s most powerful marketing features. For traders who pass the evaluation programs (1, 2 Standard, and 3-Phase), the firm allows them to request the first profit payout immediately. It is not necessary to wait a minimum number of days or reach a profit target on the funded account; simply making a single profitable trade is enough to request the withdrawal.

Subsequent Withdrawal Frequency

After this first on-demand payout, the standard withdrawal frequency is monthly (every 30 days). However, traders can opt for the “Bi-Weekly Payouts” add-on to reduce this period to 14 days. The Instant Funding and 2-Phase Classic program accounts have a fixed 14-day payout cycle from the start.

Withdrawal Process

To process withdrawals, traders must complete an identity verification (KYC). Payouts are managed through the RiseWorks platform and can be received via bank transfer or cryptocurrencies.

The “Withdrawal Drawdown Lock-in”

This is, without a doubt, FXIFY’s most critical and potentially dangerous rule. It applies to the funded accounts of the 1 and 2-Phase programs. The rule stipulates that, at the moment a trader requests a withdrawal, their maximum drawdown limit is reset to the initial account balance.

This creates a paradoxical situation. A trader might be very excited about the “First On-Demand Payout” policy, generate a profit, and request to withdraw it in full. However, by doing so, their account would return to its initial balance, and the drawdown limit would also be reset to that level. If the trader withdraws all the profit, the account balance would be exactly at the maximum drawdown threshold, which would result in the violation and immediate closure of the account right after receiving the payout.

For example, on a $100,000 account with a 10% maximum drawdown (limit at $90,000), if a trader generates a $10,000 profit (balance of $110,000) and requests to withdraw that $10,000, the drawdown limit is reset to $100,000. When the withdrawal is processed, the account balance returns to $100,000, which does not violate the rule. However, if the drawdown is 10% static on the initial balance, the limit is $90,000. If the trader generates $5,000 and withdraws $5,000, the balance returns to $100,000 and there is no problem. The rule, as described in the source, seems to imply that the drawdown is locked at the initial balance, which means that any withdrawal brings you closer to that limit. It is a rule that demands very careful withdrawal management. Traders must withdraw only a portion of their profits to leave a safety cushion or be prepared to lose the account after a full withdrawal and have to buy a new challenge.

Scaling Plan

FXIFY offers a scaling plan for consistent traders, although this plan is not available for Instant Funding accounts.

Requirements and Process

To be eligible for a capital increase, a trader must meet the following conditions:

- Achieve a total return of 10% in a three-month period.

- Within that period, at least two of the three months must have been profitable.

Upon meeting these requirements, the trader qualifies for a 25% increase in their account capital. This review process is repeated every three months, with the possibility of doubling the account balance in future reviews if consistency is maintained.

Technical Aspects and Market Conditions

The technical infrastructure and trading conditions are decisive in a trader’s experience.

Broker, Regulation, and Security

As mentioned, FXIFY is backed by the broker FXPIG. The legal entity, FXIFY Markets Ltd, is licensed as a money broker in Labuan, Malaysia, under license No. MB/22/0097. While this is not a top-tier regulation like that of the FCA or ASIC, it provides a formal oversight framework.

Trading Platforms

FXIFY offers access to the most popular platforms in the industry: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and DXTrade. This variety allows traders to choose the platform they feel most comfortable with and that best suits their tools and strategies.

Tradable Financial Instruments

The range of available instruments is broad and covers the main financial markets, including:

- Forex currency pairs (majors and minors).

- Global stock indices.

- Precious metals like gold and silver.

- Energy commodities like oil.

- A selection of major cryptocurrencies.

Leverage

Standard leverage varies by asset type:

- Forex and Metals: up to 30:1

- Indices: up to 10:1

- Oil: up to 5:1

- Cryptocurrencies and Stocks: up to 2:1

Traders can opt to increase leverage up to 50:1 on Forex and Metals by purchasing an add-on.

Commissions and Spreads: RAW vs. All-In

FXIFY offers a choice between two pricing models, allowing traders to align transaction costs with their trading style.

- RAW Accounts: Offer very low spreads, from 0.0 pips on major pairs, in exchange for a fixed commission of $6 per lot traded. This model is ideal for scalpers and high-frequency traders.

- All-In Accounts: Have no commissions per trade, but the spreads are wider, as the transaction cost is integrated into them. This model is preferred by traders who make fewer trades or who prefer the simplicity of not having to calculate commissions.

Account Customization: FXIFY’s Add-ons

One of FXIFY’s most innovative features is the ability to customize trading accounts through “add-ons” that can be purchased during the checkout process.

| Add-on | Description | Benefit for the Trader |

|---|---|---|

| Increase Leverage | Increases the maximum available leverage up to 50:1. | Greater purchasing power and profit potential (with higher risk). |

| Increase Performance Split | Increases the profit split from the standard 80% to 90%. | Keep a larger portion of the generated profits. |

| Bi-Weekly Payouts | Reduces the payout frequency from 30 to 14 days (after the first withdrawal). | Faster and more regular access to cash flow from profits. |

| Performance Protect | Allows withdrawal of the remaining profits in the account if the drawdown is breached. | A form of “insurance” to recover part of the profits in case of an error. |

| Customise Price Feed | Allows choosing between the RAW + commission or the All-In pricing model. | Alignment of trading costs with the trader’s specific strategy. |

Customer Support and Community

FXIFY demonstrates a strong commitment to customer support by offering a wide variety of communication channels. Traders can get help through a dedicated support portal, a live chat, a contact form, and a frequently asked questions (FAQs) section. Additionally, the firm maintains an active presence on social media with official communities on Discord, Twitter, Facebook, and Instagram, fostering interaction and support among traders.

Restricted Countries

FXIFY does not offer its services to residents of several jurisdictions. The list of restricted countries includes, among others: United States, Zimbabwe, Iran, Iraq, North Korea, Cuba, Syria, Russia, Kenya, Ghana, and Venezuela. Traders are advised to check the full and updated list on the official website before registering.

FXIFY’s Strengths

- Extreme Flexibility: With five distinct funding programs and variants within them, FXIFY offers a solution for almost any type of trader.

- Broker Credibility: The connection with FXPIG provides a foundation of operational and financial soundness.

- Fast Payouts: The “First On-Demand Payout” policy is one of the most attractive in the industry.

- High Customization: The add-on system allows traders to build an account tailored to their needs.

- Permissive Trading Conditions: The ability to trade during news, hold positions over the weekend, and use EAs (in evaluation programs) offers great operational freedom.

Don't miss anything!

Get the latest news, exclusive promotions and funded trading analysis directly in your inbox