Review

General Company Information

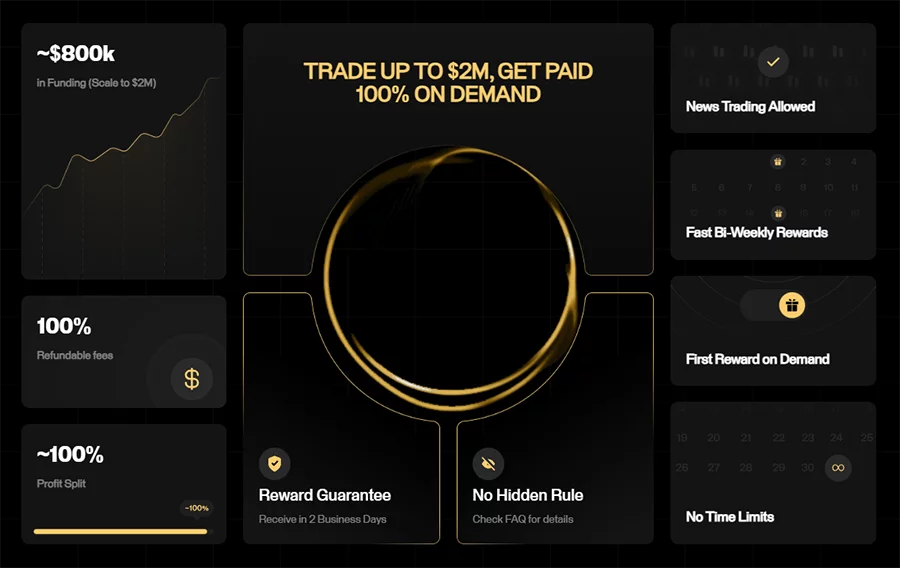

Goat Funded Trader was founded in 2022 with a clear mission: to provide the best for the best traders. Since its inception, it has relied on its own technological infrastructure, thus avoiding dependence on third-party solutions. This strategy allows it to offer a more personalized trading experience with greater control over the quality of its services.

The company is supported by a team of more than 40 professionals with industry experience, ensuring solid technical support, efficient risk management, and quality customer service.

A relevant fact about their track record is that they have paid out more than $8.1 million to their traders, demonstrating their financial strength and commitment to their users. Furthermore, in 2025 they almost fully completed their operational migration to Hong Kong, a strategy aimed at improving their market access and global positioning, despite some initial delays.

Instant Financing Plan

Available Models

Goat Funded Trader offers two instant funding models: STANDARD and GOAT.

- STANDARD: Includes “Smart Drawdown,” with an adjustable total loss limit. The initial maximum is 8% and locks in at -4% after a 4% gain. Also includes “Triple Payday,” with payments every 10 days.

- GOAT: Larger accounts at a lower price, profit sharing starting at 80%, and the option to upgrade to 100%.

Both models allow you to scale your account up to three times upon reaching a 10% profit.

Benefits

- Immediate access to trading.

- Options for different styles and risk levels.

- Frequent payments (every 10 or 14 days).

- Possibility of scaling the account and improving profit sharing.

Trading Rules

STANDARD

- Maximum daily loss: 4%.

- Maximum total loss: 8% (locked at -4% after +4% gain).

- Limit per operation: 2% of the initial balance.

GOAT

- Maximum daily loss: 3%.

- Maximum total loss: 6% at daily closing.

- Automatic closure if floating loss reaches -2%.

- Requires 5 days of trading with at least 0.5% daily profit.

Comparison Table

| Feature | STANDARD Instant Funding | GOAT Instant Funding |

|---|---|---|

| Maximum Daily Loss Limit | 4% (Trailing) | 3% (Trailing) |

| Maximum Total Loss Limit | 8% (Trailing), locked at -4% upon reaching a 4% profit | 6% (Trailing) of end-of-day capital value |

| Maximum Loss per Trade | No more than 2% of the initial balance. First violation: warning; second: cancellation. | Account closure if the floating PnL falls below -2% of the balance. |

| Profit Split (Initial) | 65% | 80% (option to upgrade to 100%) |

| Payment Frequency | Every 10 days (Triple Payday) | Biweekly (every 14 days) |

| Minimum Trading Days | Not specified | 5 days |

| Consistency Rule | Not specified | No day can be 15% or more of total earnings (does not cancel the account). |

| Account Closure Rule | Second violation of the maximum loss per trade. | Floating PnL falls below -2% of the balance. |

Account Sizes and Prices

STANDARD

| Account Size | Price |

|---|---|

| 50K | $1898 |

| 20K | $798 |

| 10K | $398 |

| 5K | $198 |

| 2.5K | $98 |

GOAT

| Account Size | Price |

|---|---|

| 100K | $767 |

| 50K | $467 |

| 25K | $307 |

| 15K | $217 |

| 10K | $147 |

| 5K | $107 |

Account Escalation

Upon reaching a 10% profit, the trader can double the account and receive 50% of those profits. This process can be repeated up to three times.

Operating Loss

- In STANDARD: Maximum 2% per operation.

- At GOAT: There is no limit per trade, but the account is closed if the floating loss exceeds -2%.

2-Step Financing Plan

Goat Funded Trader offers three variants of the two-phase evaluation model: Standard, GOAT, and Pro.

Standard Model

Phases

- Phase 1: Target 10%, minimum 3 days.

- Phase 2: Target of 5%, minimum 3 days.

Boundaries

- Daily loss: 5%.

- Total loss: 10%.

Rewards

- 80% distribution.

- On-demand payment option and 100% upgrade.

| Account Size | Price |

|---|---|

| 200K | $974 |

| 100K | $524 |

| 50K | $294 |

| 25K | $194 |

| 15K | $154 |

| 8K | $84 |

| 5K | $44 |

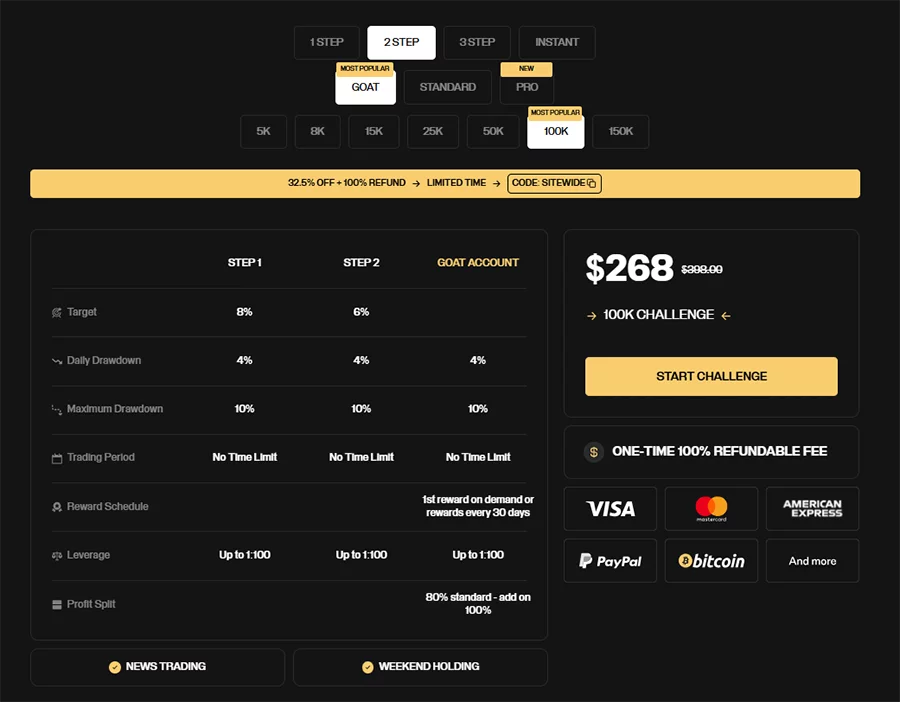

GOAT Model

- Phase 1: 8% of target.

- Phase 2: 6% of objective.

- Daily limit: 4%.

- Total loss: 10%.

Allows on-demand rewards from the third day (40%) or payments every 30 days.

| Account Size | Price |

|---|---|

| 150K | $598 |

| 100K | $398 |

| 50K | $238 |

| 25K | $138 |

| 15K | $88 |

| 8K | $48 |

| 5K | $30 |

Pro Model

- Phase 1: 8%.

- Phase 2: 4%.

- Daily limit: 4%.

- Total loss: 8%.

Allows on-demand payment after 3 days, 80% distribution.

Comparison of Evaluation Models

| Feature | 2-Step Standard Model | 2-Step GOAT Model | 2-Step Pro Model |

|---|---|---|---|

| Phase 1 Profit Target | 10% | 8% | 8% |

| Phase 2 Profit Target | 5% | 6% | 4% |

| Maximum Daily Loss Limit | 5% | 4% | 4% |

| Maximum Total Loss Limit | 10% | 10% | 8% |

| Minimum Trading Days | 3 | 3 | 3 |

| Standard Reward | 80% | 80% | 80% |

| First Reward On Demand | Optional | Yes (40% split) | Yes (40% split) |

| Payment Cycle | Bi-weekly | First on Demand/Monthly | Bi-weekly |

| Key Benefits | Standard | Lower Phase 1 target, flexible default rewards | Lower Phase 2 target, lower total maximum loss |

3-Step Financing Plan

A model designed to thoroughly evaluate the trader in three stages.

Objectives and Rules

- Objective in each phase: 6%.

- Daily loss: 4%.

- Total loss: 8%.

- Minimum 3 days of trading per phase.

- Static drawdown in all phases.

Rewards

- Initial distribution of 80%, option to upgrade to 100%.

- Payments every 14 days or on demand.

- Daily profit limit: $3,000.

- First two withdrawals limited to 6% of the initial balance.

Account Sizes and Prices

| Account Size | Price |

|---|---|

| 200K | $665 |

| 100K | $365 |

| 50K | $225 |

| 25K | $145 |

| 15K | $85 |

| 10K | $65 |

1-Step Financing Plan

Simple evaluation with a single phase.

Requirements

- Profit target: 10%.

- Minimum 3 days of trading.

- Daily limit: 4%.

- Total loss: 6%.

Rewards

- 80% distribution, with the option to upgrade.

- Biweekly and on-demand payments.

| Account Size | Price |

|---|---|

| 200K | $1050 |

| 100K | $590 |

| 50K | $339 |

| 25K | $230 |

| 15K | $170 |

General Comparison Table

| Feature | Instant (STANDARD) | Instant (GOAT) | Standard (2 Steps) | GOAT (2 Steps) | 3 Steps | 1 Step |

|---|---|---|---|---|---|---|

| Steps | 0 | 0 | 2 | 2 | 3 | 1 |

| Profit Target | None | None | 10%/5% | 8%/6% | 6%/6%/6% | 10% |

| Profit Split | 65% | 80% | 80% | 80% | 80% | 80% |

| Max Daily Loss | 4% | 3% | 5% | 4% | 4% | 4% |

| Max Total Drawdown | 8% | 6% | 10% | 10% | 8% | 6% |

| Payment Frequency | Other (10 days) | Bi-weekly | Bi-weekly | Monthly | Bi-weekly | Bi-weekly |

| Pay On Demand | No | No | No | Yes | No | No |

General Trading Rules

Profit Objectives

They vary depending on the plan. Instant has no target. Other plans range from 4% to 10%.

Loss Limits

- Daily: 3%–5%.

- Total: 6%–10%.

- Smart Drawdown is applied in Instant.

Trading Days

They require at least 3 days, except for Instant plans, which do not impose a minimum.

Strategy Restrictions

Many strategies are allowed, including news trading and the use of EAs. Prohibited:

- Arbitration

- Insider information

- Front-running

- Third-party strategies designed to overcome challenges

- Strategy changes between phases and funded account

Martingale, one-sided bets, grid bets, and HFT are prohibited in Instant Funding.

News Trading

Allowed, but with a 1% profit restriction on trades made 2 minutes before or after high-impact news.

Night and Weekend Positions

Allowed on most plans.

EAs

Allowed, except for restrictions on Instant accounts.

Deposits and Withdrawals

Accepted Methods

- Card

- PayPal

- Crypto

- Apple Pay / Google Pay

- UPI

Withdrawals

- Through Rise Pay.

- Crypto or bank transfer.

- Minimum limit: $100.

- Payment limit: $1,000 (crypto), $5,000 (Skrill).

- Daily earnings limit: $3,000.

- First two payments: max. 6% of the initial balance.

72-hour payment guarantee or $250 bonus.

Available Instruments

- Currencies

- Indexes

- Raw Materials

- Cryptocurrencies

Restricted Countries

Bangladesh, Bulgaria, Chile, Cuba, Ethiopia, Hong Kong, Indonesia, Iran, Jordan, Japan, Lebanon, Libya, Malaysia, Myanmar, North Korea, Russia, Senegal, Singapore, Somalia, South Korea, Sri Lanka, Sudan, Syria, Togo, Thailand, Vietnam.

Customer Support

24/7 support through:

- Live Chat

- Social networks: Instagram, Discord, X, YouTube

Responses within 24 hours; 48 hours via the contact form.

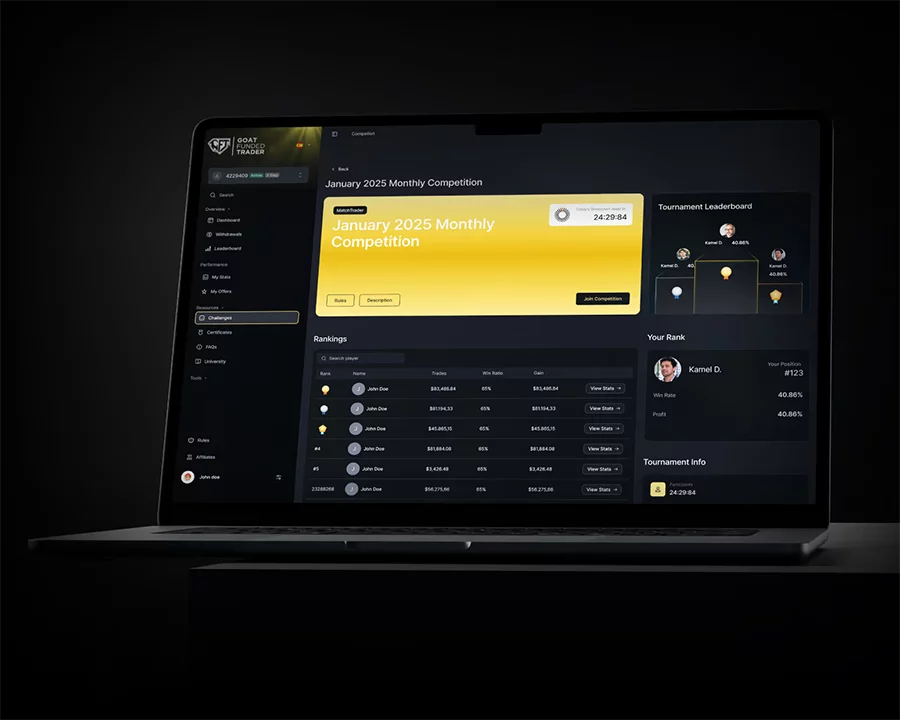

Technical Aspects

Trading Platforms

They initially offered MT4 and MT5, although they have had licensing issues. They currently operate with:

- TradeLocker

- MatchTrader

Coming soon: cTrader.

Available on web, desktop, iOS and Android.

Broker

This is not specified on the official website. ThinkMarkets is mentioned online as a potential partner. They are also identified as a “Liquidity Provider.”

Leverage

Assessment:

- Forex: 1:100

- Indices/Raw Materials: 1:20

- Crypto: 1:2

Funded Account:

- Forex: 1:50

- Indices/Raw Materials: 1:10

- Crypto: 1:2

An increase may be requested depending on the risk.

Commissions

- Forex and metals: $5 round trip.

- Indices, commodities and crypto: $0.

Strengths of Goat Funded Trader

- Fast payments and varied methods.

- Intuitive dashboard.

- Transparency and no hidden charges.

- Competitive profit sharing.

- Flexibility in trading strategies and schedules.

- Attractive scaling program.

- 24/7 and multi-channel support.

- Wide variety of plans and affordable prices.

- Refunds on some plans with the 4th payment.

- Own platform.

- Possibility of payment on demand.

Don't miss anything!

Get the latest news, exclusive promotions and funded trading analysis directly in your inbox