Review

General Company Information

The Trading Pit seeks to redefine global trading with an innovative super app, connecting traders and investors in a secure ecosystem. Led by Daniela Egli, Artem Lomakin, and Illimar Mattus, with over 50 years of combined experience in brokerage and entrepreneurship.

Their goal is to empower traders with tools for financial independence, based on innovation, security, and trust. They foster a collaborative community, offering comprehensive support and education, and seek to make trading accessible and successful.

Pinorena Capital, Illimar Mattus’s fintech firm, is the majority owner, providing access to extensive resources.

Management Team

The management team has over 100 years of experience in investment banking and brokerage, aiming to be a global leader in proprietary trading through a robust platform, advanced technology, and expertise.

- Illimar Mattus (Founder): Over 20 years of experience, providing strategic advice and expanding global presence. He is a key investor through Pinorena Capital. He co-founded Tickmill and believes in providing fair opportunities.

- Daniela Egli (CEO): Over 15 years of experience in financial services (business development, management, compliance, M&A). Qualified (CySEC Advanced, AML, CISI, CFA Level 1). Former CEO/COO of Skilling and Director at FXview. Focused on operations in Cyprus and support for traders/partners.

- Artem Lomakin (CTO): Over 20 years as CTO of B2B-Center. PhD in Computer Science, expert in high-load SaaS. He leads R&D, implements data-driven approaches, and uses ML/AI.

- Alberto Konstantinou (Client Operations Manager): Over 12 years in operations. Oversees logs, interdepartmental communication, and user experience.

- Nuria Medrano Misas (Head of Marketing): Over 13 years of experience launching global brands and campaigns. Develops lead acquisition and storytelling strategies. Master’s degree in International Business and legal training.

- Fanos Kyriakou (Risk Manager): Over 10 years of experience in trading and risk management. He leads operations, specializing in CFD brokerage, risk management, and compliance. He holds a degree in Economics and holds a CySEC Advanced Certificate.

- Edita Pjevič (Group Finance Manager): Experience in financial management, strategic planning, and corporate finance. Oversees financial operations. Master’s degree in Finance and Business Valuation.

Legal Compliance

The Trading Pit prioritizes a legally compliant business model, advised by capital markets law experts. Its partnership models with proprietary traders are transparent and have not faced regulatory challenges.

The site is operated by The Trading Pit Challenge GmbH (Liechtenstein, FL-0002.693.417-1). All accounts are demo accounts with virtual capital in a simulated environment.

Prime Program for CFDs

Simplified approach with 1-Phase Assessment (rapid progress) or 2-Phase Assessment (steady progress). Available balances: $5k, $10k, $20k, $50k, $100k, $200k.

Key Rules

- Daily drawdown based on equity

- Maximum trailing drawdown (highest equity)

- Minimum 3 days of trading

- 21 days of inactivity closes the account

- Maximum 4 CFD accounts (total $400k)

- Consistency rule (best day <= 40% target)

- Allows you to maintain positions over the weekend.

Earnings Phase

- 80% profit sharing

- First payment after 5 days of trading

- Subsequent payments every 14 days (min. $100), processed Tuesdays and Fridays.

Scaling

25% balance increase if the account is active for 2 months, with 2 payments and 10% total profit. Every 4th payment establishes a new base.

Prime Futures Program

Accounts and Prices

$50,000 for $99; $100,000 for $189; $150,000 for $289. Activation fee $129. Reset/extension options apply.

Key Rules

Daily Pause Limits: $1k ($50k), $2k ($100k), $3k ($150k). Reaching the limit liquidates positions and pauses trading. Max Drawdown: $2k, $3k, $4.5k (trailing to initial balance, then fixed). Challenge duration: 30 days. Minimum 3 trading days. 21 days of inactivity closes the account. Maximum 5 Futures accounts. Overnight positions closed by 3:55 PM CT. 40% consistency rule. News trading allowed (with risk warning). Copy-trading allowed (up to 5 own accounts).

Payments and Scaling

80% profit sharing. 1st payment: min. 3 trading days, 10 profitable days (= $200). 2nd payment: 5 profitable days (= $200). Subsequent payments every 7 days (min. $200), processed Tuesdays and Fridays. Purchasing power scales daily (4:00 PM CT) based on profit.

Classic Futures Program

Accounts and Prices

$20,000 for $99; $150,000 for $169; $200,000 for $349; $250,000 for $599. Reset/extension options with fees.

Key Rules

Daily drawdown limits vary by account/phase. Max drawdown: $500, $3k, $3.5k, $5k (trailing max balance). Min. 3 trading days/phase. Challenge duration: 30 days ($20k/$150k) or 60 days ($200k/$250k). Inactivity 21 days. Max 5 Futures accounts. Overnight trading allowed, but all Fridays close at 4:00 PM CT. Weekend holdings prohibited. Consistency 40%. High-impact news trading prohibited (+/- 2 min). Copy-trading allowed (up to 5 accounts).

Benefits and Payments

Up to 70% ($20k/$150k) or 80% ($200k/$250k). Scaling upon reaching target, simultaneous payout. Payouts Fridays.

Differences and Unique Features

- Prime vs Classic: Prime emphasizes accelerated progress (1 or 2 phase CFDs, 1 phase Futures) and buying power scaling. Classic (Futures) uses a scaling plan tied to profit targets.

- Part. Benefits: Prime is usually 80%. Classic starts lower (50-60%) and can increase.

- Overnight: Prime CFD is allowed; Prime Futures is prohibited; Classic Futures is allowed (closed Fridays).

- Trading News: Prime Futures allowed (with warning). Classic and Prime CFDs prohibited (+/- 2 min high impact).

- Daily Risk Management: Prime CFDs (equity drawdown); Prime Futures (daily pause with settlement); Classic Futures (daily drawdown, may result in account breach).

Account Sizes and Prices

Prime CFD Account Comparison Table

| Balance | Price | Evaluation Phases | Daily Drawdown | Max Drawdown | Target Profit | Min Trading Days | Profit Part | Scaling Plan | Payout Frequency |

|---|---|---|---|---|---|---|---|---|---|

| $5,000 | Not specified | 1 or 2 | Equity-Based | Trailing Equity Max | Not specified | 3 | 80% | Yes | Every 14 days |

| $10,000 | Not specified | 1 or 2 | Equity-Based | Trailing Equity Max | Not specified | 3 | 80% | Yes | Every 14 days |

| $20,000 | Not Specified | 1 or 2 | Equity Based | Trailing Equity Max | Not Specified | 3 | 80% | Yes | Every 14 Days |

| $50,000 | Not Specified | 1 or 2 | Equity Based | Trailing Equity Max | Not Specified | 3 | 80% | Yes | Every 14 Days |

| $100,000 | Not Specified | 1 or 2 | Equity Based | Trailing Equity Max | Not Specified | 3 | 80% | Yes | Every 14 Days |

| $200,000 | Not Specified | 1 or 2 | Equity Based | Trailing Equity Max | Not Specified | 3 | 80% | Yes | Every 14 Days |

Prime Futures Account Comparison Table

| Balance | Price | Phase 1 Contracts | Profit Target | Daily Pause | Max Drawdown | Challenge Duration | Activation Rate | Profit Part | Profit Phase Scaling | Payout Freq |

|---|---|---|---|---|---|---|---|---|---|---|

| $50,000 | $99 | 5 Standard / 50 Micro | $3,000 | $1,000 | $2,000 | 30 Days | $129 | 80% | Yes | Every 7 days |

| $100,000 | $189 | 10 Std / 100 Micro | $6,000 | $2,000 | $3,000 | 30 Days | $129 | 80% | Yes | Every 7 days |

| $150,000 | $289 | 15 Std / 150 Micro | $9,000 | $3,000 | $4,500 | 30 Days | $129 | 80% | Yes | Every 7 days |

Classic Futures Account Comparison Table

| Balance | Price | Phase 1 Contracts | Profit Target | Daily Drawdown | Max Drawdown | Challenge Duration | Profit Part | Profit Phase Scaling | Payout Freq |

|---|---|---|---|---|---|---|---|---|---|

| $20,000 | $99 | 10 Micro | $1,000 | $250 | $500 | 30 Days | Up to 70% | Yes | Every Friday |

| $150,000 | $169 | 5 Standard / 50 Micro | $5,000 | $1,500 | $3,000 | 30 Days | Up to 70% | Yes | Every Friday |

| $200,000 | $349 | 7 Standard / 70 Micro | $3,000/Phase | $2,000/$1,000 | $3,500 | 60 Days Total | Up to 80% | Yes | Every Friday |

| $250,000 | $599 | 10 Standard / 100 Micro | $3,000/Phase | $2,000/$1,000 | $5,000 | 60 Days Total | Up to 80% | Yes | Every Friday |

Trading Rules

Fundamental Rules

- Complete challenge = reach goal + close positions.

- Inactivity 21 days = account closure (no refund/new account).

- Consistency: Best day <= 40% total target.

- It is forbidden to reach the target in a single operation.

- Maintain consistent strategy, standard risk management.

- Exploiting system errors or slow/external data is prohibited.

- It is forbidden to open operations < 2 hours before the market closes to take advantage of gaps.

Specific Rules for CFDs

- Daily Drawdown: Loss limit per day (updated 4:00 PM CT). Prime CFD: Equity-based.

- Max Drawdown: Total allowable loss. Prime CFD: Max trailing equity.

- Min. trading days: 3 (Prime), 5 (Classic).

- Account limit: 4 active (max 1 Classic), total $400k.

- Copy-trading: Not allowed between your own accounts. Allowed from your own external accounts; prohibited from others.

- News Trading: Classic prohibited (+/- 2 min). Prime permitted.

- Scalping/HFT: Prime scalping allowed; HFT prohibited. Classic: trades more than 1 min. HFT prohibited.

Specific Rules for Futures

- Prime: “Daily Pause” (max loss -> liquidation + pause). Classic: “Daily Drawdown” (exceed -> account violation). (Both updated 4:00 PM CT).

- Max Drawdown: Total loss (trailing end-of-day balance to initial level).

- Min. trading days: 3 per phase.

- Account limit: 5 active.

- Overnight: Prime: Risky, enforced closing time 3:55 PM CT. Classic: Permitted, closed all Fridays 4:00 PM CT; prohibited on weekends.

- Copy-trading: Allowed up to 5 own accounts (Prime: not between Challenge/Earning; Classic: not from others).

- News Trading: Prime allowed (with warning). Classic prohibited (+/- 2 min).

- Hedging: Prohibited (opposing positions in separate accounts).

Information on Deposits and Withdrawals

Deposits

- Apple Pay

- Google Pay

- PerfectMoney

- Skrill

- Card

- Bank transfer

- Crypto

Withdrawals

- Crypto

- Transfer

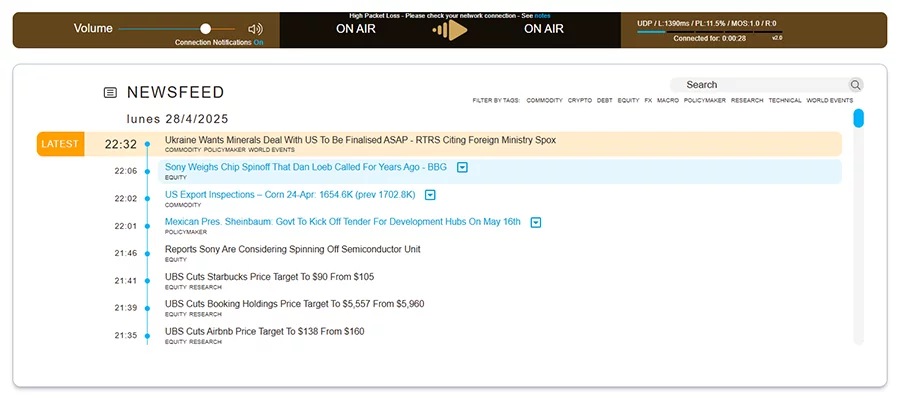

LiveSquawk

LiveSquawk is a real-time financial news service integrated into The Trading Pit platform, designed to give traders an informational edge. The Trading Pit provides access at no additional cost to its traders (on a challenge basis), helping them stay up-to-the-minute informed, understand market context, and make more informed trading decisions.

Real-Time News (Audio “Squawk”)

Its main feature is a live audio stream that announces economic news, events, and key market-moving data, virtually instantly (“low latency”). This allows traders to react quickly.

Additional Tools:

- A newsfeed with constant news headlines.

- Daily reports (morning, afternoon) summarizing the highlights.

- Expert analysis with comments on the impact of the news.

- An integrated Economic Calendar to track important events.

Global Coverage

Reports on events affecting equities, currencies, fixed income, and commodities worldwide, with a focus on key financial centers.

Information Filtering

It gathers news from multiple sources (agencies, websites, social media) but filters it to deliver only the most relevant and critical information for traders.

Personalization

Allows you to configure alerts to receive specific notifications based on each trader’s interests.

Key Advantage in The Trading Pit

Access to LiveSquawk is free for all traders who have purchased a challenge from The Trading Pit. This represents a considerable savings and significant added value, as these services typically require a paid subscription.

Easy Access

The Trading Pit users can access LiveSquawk directly from their Client Area.

Instruments

CFDs

Forex

- Leverage: 1:50

- Commissions: $5/lot

Raw Materials

- Leverage: 1:10

- Commissions: $5/lot

Indexes

- Leverage: 1:10

- Commissions: $5/lot

Crypto

- Leverage: 1:2

- Commissions: 0.20%

Actions

- Leverage: 1:2

- Commissions

- US: 0%

- EU/UK: 20%

Futures

To learn which instruments can be traded in a futures account, as well as commissions and other information, please consult this link

Restricted Countries

- No service: Burundi, Cuba, Iran, North Korea, South Sudan, Sudan and Syrian Arab Republic.

- CFDs: USA, Canada and Russia.

- Rithmic (Futures): Myanmar, Bonaire, Sint Eustatius and Saba, Sint Maarten, Afghanistan, Libya, Palestine, Iraq, Somalia and Zimbabwe.

- DxFeed (Futures): Iraq & Belarus.

Technical Aspects

Platforms and Brokers

CFDs

- Metatrader 5

- Metatrader 4

- cTrader

Futures

Tradovate, TradingView (with Tradovate), NinjaTrader, ATAS, Quantower, VolFix, Rithmic/R Trader.

Broker

- GBE

- OrbexOrbe

Strengths of The Trading Pit

- Financing programs for CFDs and Futures.

- Prime programs with 80% share of benefits.

- Clear scaling plans in both programs.

- Wide range of CFD instruments.

- Support multiple professional platforms for Futures (Tradovate, NinjaTrader).

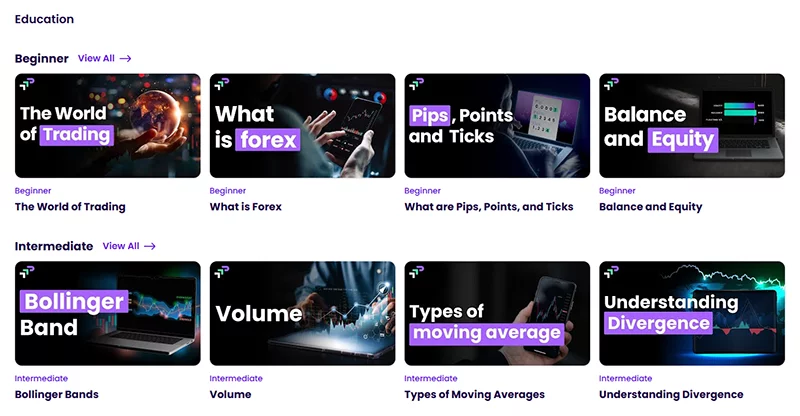

- Abundant educational resources (blogs, webinars, etc.).

- Multiple support channels.

- Emphasis on legal compliance and transparency.