Earn money by buying funding accounts

Get back 5% of your purchase price from FXIFY

Stackable with other promotions

Earn money by buying funding accounts

Get back 5% of your purchase price from FXIFY

Stackable with other promotions

Review

General Company Information

FXIFY is a London-based investment firm founded in 2023 by Peter Brown and David Bhidey. Thanks to their exclusive partnership with broker FXPIG, they offer a great trading experience, with very competitive spreads, a wide range of instruments (including stocks), and the option to use Metatrader 4 and 5.

It has fairly permissive rules and offers 1-, 2-, and 3-phase testing at more than reasonable prices, making it a great option for a large majority of traders.

Evidence

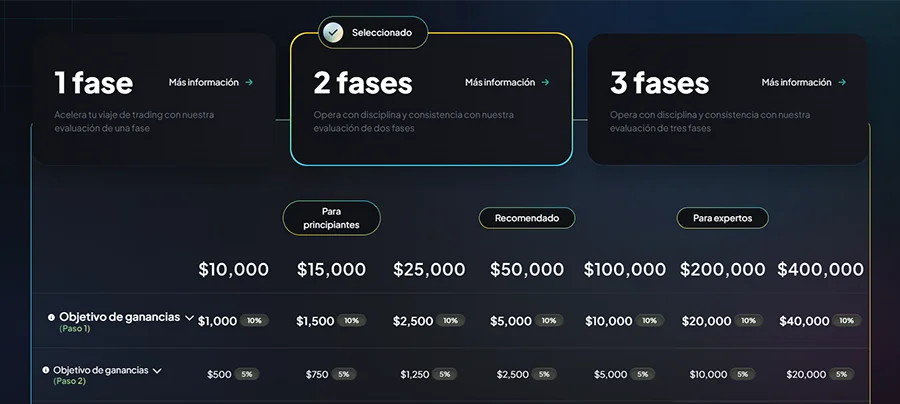

Avoiding complications, FXIFY only offers three types of trials (phase 1, phase 2, and phase 3), with minimal differences between them. With trial sizes from $10,000 to $400,000, we have a price range for all budgets, from $59 to $1,999.

Phases

- The price of the 1 and 2 phase tests is the same, while the 3 phase test is lower.

- The total maximum drawdown is static in phase 2 and 3 tests, and hybrid in phase 3 tests. This rule remains the same even after the test has passed.

- The maximum daily drawdown is balance-based and is 5% on all accounts.

- The total profit target is 10% in phase 1 tests, and 15% in phase 2 and 3 tests.

- The rest of the rules and characteristics are the same in all tests.

Raw vs All-in

You can choose between two types of accounts based on spreads and commissions. The raw option offers minimum spreads with commissions per trade, while the all-in option has higher spreads but no additional commissions.

Rules

News

News trading is permitted, and there don’t appear to be any restrictions, as we find with many other firms. However, be warned that during periods of high volatility, spread and slippage can spike, and orders can be closed at levels much lower than those configured.

In the English version of the documentation, it states that traders who trade at high risk during news events may be banned. This is understandable, as they need to protect themselves from gamblers, but it’s also the kind of ambiguous rule that people don’t like to see, and that many other companies unscrupulously use to avoid paying out when it’s not in their best interest.

Weekend

It is possible to keep trades open over the weekend.

Stop Loss

The use of Stop Loss is not mandatory.

Minimum days operated

A minimum of 5 days of operation is required for each phase of the test.

Time limit

There is no time limit on any of the tests.

EAs

The use of EAs is permitted.

Martingale and grid

It is allowed to operate with martingale and grid type strategies.

Hedging

It is allowed to have open positions in both directions on the same asset.

Inactivity

If the trader does not trade for 60 days, his account will be cancelled.

Account Merger

It is not possible to merge multiple accounts

Maximum capital

Only one account of each size can be operated simultaneously. It is possible to have two accounts of the same size, but they must be built one after the other, and both cannot be operated simultaneously during the funding phase.

The documentation says that the maximum capital would be $800k with two $400k accounts, but according to the rule described above, I don’t see why you couldn’t also have two of each of the lower sizes, and therefore a higher maximum capital.

Prohibited Practices

As is common with all funding companies, FXIFY has a large number of prohibited practices. Some of these include HFT bots, group hedging, and account sharing.

At this point, I always recommend reviewing the documentation firsthand. You can find the information you need at this link and this other one.

Funded Account Rules

The rules for a funded account are the same as those for the test the trader completed to obtain it. That is, you shouldn’t trade a funded account obtained with a phase 1 test the same way you would with a phase 3 test, as the level and type of drawdown will be different.

Total Maximum Drawdown

The total maximum drawdown is static in phase 2 and phase 3 tests, and hybrid in phase 1 tests. This rule remains the same even after the test has passed.

Hybrid Drawdown

The hybrid drawdown increases based on the maximum balance until it reaches the initial balance level, after which point it no longer increases.

To illustrate this with an example, imagine having a $100,000 test balance. The maximum drawdown is 6%, so if the balance drops below $94,000, the test would fail. If the balance increases to $103,000, the maximum drawdown would now be $97,000. If it increases to $106,000, the drawdown would be $100,000. If the balance increases further, the maximum drawdown will no longer exceed the initial balance of $100,000.

Maximum daily drawdown

It is defined with respect to balance at the beginning of the day (5pm EST).

Trade Copier

Trade copiers are permitted between FXIFY accounts. Copying from your own external account is also permitted, although you’ll need to contact support to verify this.

Characteristics

Monthly Competition

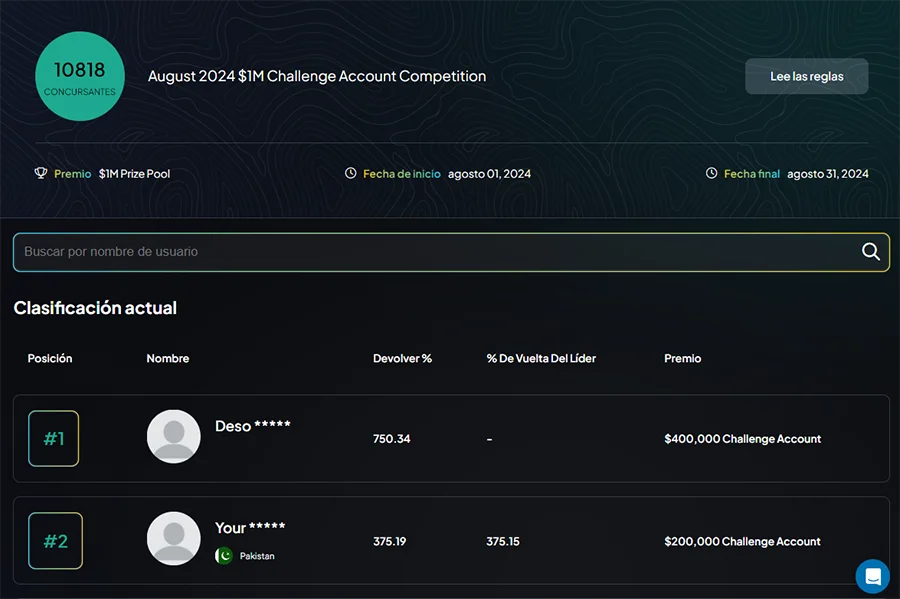

FXIFY is one of the few funding companies that still offers a monthly competition. Prizes consist of funding trials of between $25k and $400k for the top 10 finishers. Returns are calculated based on account size, so having a small account can’t hurt.

Unfortunately, this competition does not allow traders using EAs, so only manual traders will be able to participate.

Scaling

If you achieve a 10% or more profit in your first 3 months, with at least 2 of those months in the black, your account size will increase by 25%. This can be repeated multiple times, reaching a maximum of $4 million over 12 months with a $400,000 account.

Based on the documentation, it’s unclear whether this time limit also applies to smaller accounts, or whether they can continue to escalate for longer.

I’m also not sure if it’s essential for this winning streak to occur from the moment the account is acquired and without interruption. In the absence of clarification, it’s assumed that this is the case.

Add-on

FXIFY offers 4 different add-ons:

- Profit Protection: Protects the profit earned in a funded account in the event of the daily drawdown. In this case, the remaining profit can be withdrawn after the account has been lost. Price: +15% of the test price.

- Improved Profit Split: Increases profit split from the normal 75% to 90%. Price: +20% of the test price.

- Improved Leverage: Increases leverage for currencies and gold to 50:1, up from 30:1. Price: +20% of the test price.

- Payment every 15 days: Allows you to withdraw every 15 days instead of 30. +15% of the test price.

Pay on demand with cashback

The first withdrawal can be made immediately after receiving the funded account, provided that at least one position has been closed in profit. This payment will also include a full refund of the test price, including add-ons.

Technical details

Broker

FXIFY uses the FXPIG broker, which has been operating in Vanuatu since 2010. This broker has a long track record and a good reputation within the trading community.

Platforms

- Metatrader 5

- Metatrader 4

- DXTrade

Instruments

As is typical with CFD prop firms, at FXIFY you can trade currencies, indices, and commodities. In this case, we also have the main American stocks available. This will be very useful for traders who know how to profit from these types of assets or are looking for new ways to diversify their strategies.

On the website, they claim to have more than 300 different assets, but my broker has just over 100 available. I don’t know if there’s been any recent changes or if it has to do with the type of platform used.

Leverage

- Currencies and commodities → 30:1 (50:1 with add-on)

- Indexes → 10:1

- Stocks → 2:1

- Crypto → 2:1

Spreads and commissions

There are two types of accounts: RAW spread and All-in

Raw spread

This is the standard account you can find at most companies and brokers. The spreads fall into my personal category of “very good,” while the fixed commission is $6 per lot round trip.

All-in

In this type of account, there are no transaction fees, except for stocks, which have a commission of 0.35% of the transaction value (round trip).

The spreads are considerably higher than in the Raw type.

Decision

The spread and fixed commission don’t differ much in practice. For example, in EURUSD, every 0.1 pip of spread represents a cost of $2 per trade per lot (round trip).

With a commission of $6 per lot, if the spread difference between All-in and Raw is 0.3 pips, the cost per trade will be the same in both account types. If the difference is greater, we will pay more commission in the All-in account. And if the difference is smaller, the cost per trade will be higher in the Raw account.

The cost to pay for the higher spread seems to be systematically higher than that of the fixed commission, at least according to the data available on the website, so in principle I would not recommend choosing the All-in account.

I’ve seen mentions on the website that the all-in version is better for swing traders or position traders. Unless I’m missing something, this isn’t true. It might have made sense if the all-in account also didn’t have swap fees, but according to the documentation, all FXIFY accounts have this fee.

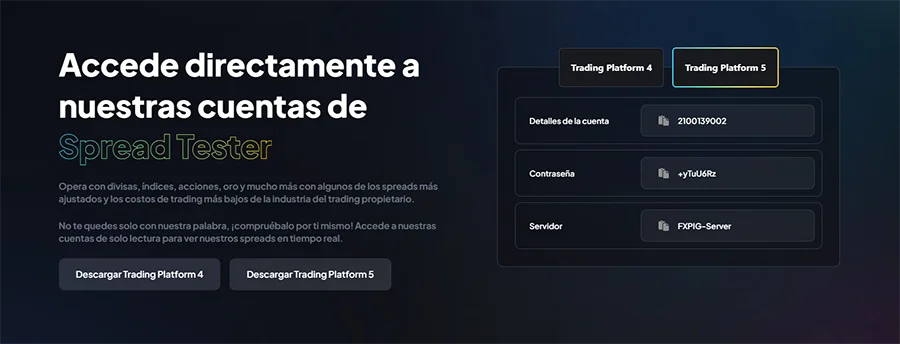

Demo Account

Nothing beats seeing for yourself the spreads and other specifications of the instruments you want to trade.

At this link you can find the credentials to access a demo account on different terminals and account types.

IP Restriction

There’s no problem with using different devices to manage operations or doing so from different IP addresses.

FXIFY will be more vigilant about using the same IP address or device to manage multiple accounts. Even in this case, they assure us that they will contact the trader to request an explanation before canceling the account.

Web

Although it is a bit too cluttered for my taste, I have to admit that the FXIFY website is very well done and does its job perfectly.

On the home page, we can see a summary of almost all the important aspects we want to know about a prop firm, perfectly summarized and organized, and with a striking and professional design.

The loading speed isn’t outstanding, but it’s certainly good, given the complexity and functionality of the website.

User Area

The user area doesn’t lower the already excellent overall rating of the FXIFY website, but rather improves it. No functionality is missing, and everything works well and quickly.

The trading tools (calendar, analyst views, and highlighted ideas) are quite impressive. I don’t know how useful they’ll be for an experienced trader, but they work really well.

Languages

The website is available in only two languages: English and Spanish.

Documentation

There are quite a few prop firms whose documentation leaves something to be desired, whether in terms of content quality, organization, or user experience. Fortunately, FXIFY is a welcome exception, which in my opinion offers high-quality documentation in all aspects.

Payments and withdrawals

Payment Methods

- Card

- Crypto

Withdrawal Methods

Benefit payments are made through the Rise service. After creating an account and receiving the benefits in your balance, you can withdraw them using:

- Transfer

- Crypto

Withdrawal Conditions

- Withdrawals are processed from 9am to 9pm GMT Monday to Friday.

- The first on-demand payment after the first transaction ends in the black.

- The following payments are every 30 days, or 15 days if the corresponding add-on is purchased.

Withdrawal in 1-phase accounts

Because the hybrid drawdown persists after the testing phase, withdrawing profits is something that should be done with extreme caution on this type of account.

The best way to explain this is with an example. Imagine you have a $100,000 account from an already funded phase, in which you make a profit of $6,000. Since the drawdown is a hybrid drawdown of 6, it will follow your account equity until it reaches $100,000, at which point it will no longer increase. If you were to withdraw that $6,000 profit now, your account would be instantly closed because it had reached the maximum drawdown allowed.

With this in mind, it’s up to you how you manage your withdrawals. The most conservative approach is to always leave 6% in the account. You can also withdraw more and leave, for example, $103,000. The problem is that in this case, your trading margin is greatly reduced, and the chances of losing your account multiply.

Medium

I’ve had some contact with FXIFY support and my experience has been very good. This isn’t something that can be extrapolated to the general case, but I still think it’s worth mentioning.

Restricted Countries

Currently, traders from the following countries are not eligible to trade with FXIFY:

Afghanistan, Algeria, Burundi, Central African Republic, Republic of the Congo, Crimea, Cuba, Democratic Republic of the Congo, Eritrea, Ghana, Guinea, Guinea-Bissau, Iran, Iraq, Ivory Coast, Kenya, Liberia, Libya, Myanmar, Nicaragua, North Korea, Palestine, Papua New Guinea, Russia, Somalia, South Sudan, Sudan, Syria, Vanuatu, Venezuela, Vietnam, Yemen, Zaire, Zimbabwe.

My opinion on FXIFY

What I like the most

- Simple test catalog. 1, 2, and 3 phases, no more, no less. The only difference is the hybrid drawdown in the 1-phase test.

- Clean and useful dashboard. Direct and concise website and documentation.

- Permissive rules. Trade your way without having to worry about complicated rules that could cause you to lose your account.

- Excellent trading conditions, with very tight spreads and MT4 and MT5 available.

- Full refund upon completion of the trial.

- The feeling that it’s a company that wants to do things right. No one knows what goes on behind the scenes in this sector, but my overall impression is that it’s probably a serious company with good management.

What I don’t like

- Trailing drawdown for a single-stage trial is something I don’t like, but I understand why it’s that way. The truth is, the vast majority of companies with a single-stage option have this type of drawdown.

- The fact that the hybrid drawdown is also inherited by the funded account, and that this leads to the possibility of losing the account simply by making a withdrawal, seems a little odd to me. Still, they explain it well and explicitly.

- I don’t see any real value in the All-in account if it still has swap fees. According to the spreads available on the website, the cost per trade is consistently higher for all or most instruments.

- They supposedly have more than 300 instruments, but I’ve only seen about 100, I don’t know what the others are.