Review

General Company Information

Apex Trader Funding, founded in 2021 by Darrell Martin, is a funding company that stands out for its focus on futures trading. It offers flexible underwriting with clear rules and adaptable trial times, making it an attractive option for experienced traders looking for a transparent structure without surprises.

An important feature of Apex is that it allows you to retain up to 100% of your profits on the first $10,000, and it’s possible to have up to 20 simultaneous accounts. It also offers recurring discounts, making it easy for those looking to scale quickly. Apex has earned a reputation for its simple withdrawal terms and no monthly limits, making it a competitive option for futures traders.

Evidence

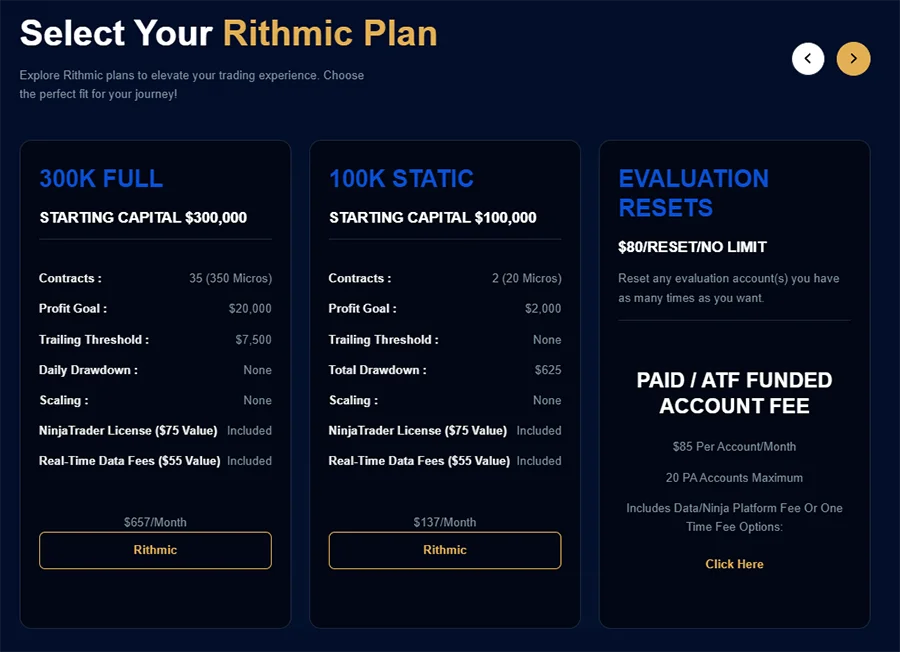

The differentiation between the types of tests we will find in Apex is determined by the choice of broker, the size of the account, and the type of drawdown.

Broker

There are two different brokers available to trade within Apex: Rithmic and Tradovate. Generally speaking, you’ll be able to do more or less the same things on both platforms, but there are some more specific differences to keep in mind.

Sizes, prices and conditions

Conditions are not calculated proportionally for each account size, so it’s especially important to compare them all carefully before making a decision.

These are the current monthly subscription prices (they may be different by the time you read this). Historically, the Tradovate subscription was more expensive, but they recently matched the prices. Apex promotions apply a significant discount to this subscription, so in practice, the actual price is much lower.

| Size | Subscription | Contracts | Target | Drawdown |

|---|---|---|---|---|

| $25k | $147 | 4 | $1.5k | $1.5k |

| $50k | $167 | 10 | $3k | $2.5k |

| $75k | $187 | 12 | $4.25k | $2.75k |

| $100k | $207 | 14 | $6k | $3k |

| $150k | $297 | 17 | $9k | $5k |

| $250k | $517 | 27 | $15k | $6.5k |

Static Drawdown

While all other valuations have a dynamic maximum drawdown that follows the highest historical equity, this account type has a static maximum drawdown that does not change at any point throughout the valuation.

| Size | Rhythmic | Tradovate |

|---|---|---|

| $25k | $130 | $150 |

| $50k | $140 | $160 |

| $75k | $180 | $200 |

| $100k | $220 | $240 |

| $150k | $260 | $280 |

| $250k | $300 | $320 |

| $300k | $340 | $360 |

General rules

News

News trading is permitted. The only restriction is creating positions in both directions.

Close trades daily

It’s not possible to hold open positions for multiple days, and they must be closed every day before 4:59 p.m. Breaking this rule isn’t very serious, but you’ll receive warnings if you violate it frequently.

Daily drawdown

There is no rule limiting the maximum daily loss. The maximum drawdown is always general.

Inactivity

There’s no inactivity rule. You can go as many days as you like without making any trades.

Hedging

Hedging of any kind is not permitted, neither within the same account nor across multiple accounts.

Copy trades

It is possible to copy trades between all accounts within Apex or other platforms, as long as the trader is the one doing the trading.

Automation

The use of bots and trading algorithms is permitted, however, they must be actively managed and not neglected.

Assessment

At Apex, the evaluation is a single-stage process and operates on a monthly subscription basis. The main reason for this model is the need for real-time futures data. The subscription also includes the NinjaTrader software for free.

If the trader loses the account, it is possible to reset it to start from scratch. This reset costs $80 at Rithmic and $85 at Tradovate, although using the current promotion significantly reduces the price.

Alternatively, you can wait to pay the monthly subscription again, at which point a free reset will be available.

Rules

- It is necessary to operate at least 7 days before taking the test.

- There are no consistency rules like those found in a funded account. It’s possible to use ratios greater than 5:1, there’s no need to use stop losses, etc. That is, it’s possible to have aggressive trading focused solely on passing evaluations.

- Except for the $100k static account, the drawdown is dynamic (trailing), and is calculated using the account’s historical maximum equity.

- To pass the assessment, you must maintain a balance above the target. Simply achieving it isn’t enough.

- There is no flipping rule. This rule was removed in version 3.0, which limited the number of days with flipping operations.

Funded account (Performance account)

Activation

Once the evaluation is passed, the trader must choose between paying a monthly fee or making a one-time payment that is valid for life.

The monthly fee is $85 for Rithmic accounts and $105 for Tradovate accounts.

The one-time payment varies depending on the account size. The price is often discounted due to a current promotion, which typically offers a single price for all account sizes.

| Size | 30% of maximum drawdown |

|---|---|

| $25k | $450 |

| $50k | $750 |

| $75k | $825 |

| $100k | $900 |

| $150k | $1500 |

| $250k | $1950 |

| $300k | $2250 |

| $100k Static | $600 |

Profit sharing

The percentage we take from the total profits generated in each account is 100% for the first $25,000, and 90% thereafter.

Rules

- It is possible to have up to a maximum of 20 funded accounts simultaneously.

- The maximum drawdown value is equal to that of the evaluation account.

- The maximum drawdown is hybrid. It follows the maximum equity in the same way as in the evaluation account, but stops when it reaches the account’s initial balance (+$100).

- It is mandatory to use stop loss at all times.

- The stop loss can only be moved in the direction of the trade to secure profits, never against it.

- The risk/reward ratio per operation cannot exceed 5:1.

- The leverage used must be consistent. There shouldn’t be much difference between the number of contracts used in different trades.

- Martingale or DCA strategies ARE allowed. This has changed in Apex Update 3.0.

- The number of tradable contracts will be halved until the safety net is reached for the first time (see below). Once this is reached, all the contracts allowed by the account size can be used, even if the balance falls below the safety net.

The 30% rule

- According to this rule, your PnL on your open trades cannot have a negative value greater than 30% of your account’s profit at the beginning of the day.

- If your account balance is below the safety net, I calculate 30% using the maximum drawdown.

- Occasional violations of this rule carry no consequences and will likely only result in a warning. The documentation isn’t clear about what can happen if you consistently violate it, but I assume there’s a risk of losing your account.

- Reaching this value does not block the account in any way, and you can continue operating normally at the same time.

- Once the safety net is doubled, this rule becomes 50%.

| Size | 30% of maximum drawdown |

|---|---|

| $25k | $450 |

| $50k | $750 |

| $75k | $825 |

| $100k | $900 |

| $150k | $1500 |

| $250k | $1950 |

| $300k | $2250 |

| $100k Static | $600 |

Real account

Initially, once you have a funded account with Apex, it will be simulated. After a period of good results and consistency, they will analyze the account and, if they deem it appropriate, copy the trades to real accounts to obtain their own profits.

The final level is when a trader achieves very good and consistent results over a long period of time. In this case, Apex may assign them a 100% real account whose trades enter the market just like a personal account.

Brokers

We have two options to choose from: Rithmic and Tradovate

Platforms

At Tradovate, we have few options, but the ability to trade directly on Tradingview is highly appreciated by some traders. At Rithmic, we have a large selection of terminals.

- Tradovate: Ninjatrader, Tradovate platform and Tradingview.

- Rithmic: ATAS, Bookmap Edge Clear EdgeProX, Finamark, Jigsaw Trading, MotiveWave, NinjaTrader, Quantower, RTrader, Sierra Chart, VolFix, Wealthcharts.

Instruments and commissions

The instruments are almost the same across both brokers, with two exceptions: the currency instruments are slightly different, and at Tradovate we have the option to trade EUREX futures.

Commissions are generally lower at Tradovate.

Prices

Until recently, subscription prices were higher at Tradovate. Now they are the same for both brokers.

The activation prices do remain different, but are also higher for Tradovate, both for the subscription and for lifetime payments.

Web

The Apex website is generally decent. The homepage is fairly informative and has other interesting sections, such as company information, trading tools, and real-life testimonials.

Documentation

The documentation is truly extensive. They leave nothing unclear, and that’s appreciated. It also conveys a strong sense that this is a serious company that isn’t looking to deceive or take advantage of anyone.

The organization is good, and the search works quite well. What leaves the most to be desired might be the speed, which isn’t particularly good on the page in general, and even less so on the documentation.

There are two entries that compile the most important information needed before purchasing an account and starting to trade.

Educational content

Apex has an “official” trading school called the Apex Investing Institute. They offer a 30-day trial, which allows you to access their basic bootcamp without needing to link any card or payment method. You’ll also have access to their very active community.

Payments and withdrawals

Payment Methods

Card

Withdrawal Methods

Transfer (Plane)

Withdrawal Conditions

- There is a minimum balance available in the account to be able to withdraw, as well as a maximum amount to do so.

- Minimum withdrawal of $500 per account.

- There cannot be a single trading day that represents 30% or more of the profits earned since the last withdrawal (or since the account was created if there has been no withdrawal)

- A withdrawal can be made at any time, as long as you have traded for at least 8 days since your last withdrawal, and you have earned $50 or more on at least 5 of those days.

- Withdrawal is approved in less than 48 hours, and is received 3-4 business days after approval.

Safety Net

- To make a withdrawal, you must have a balance equal to or greater than the so-called safety net.

- The safety net is only applicable during the first 3 withdrawals.

- The safety net is calculated by adding the maximum drawdown of the account plus $100.

- When your balance equals the safety net, you can withdraw $500. Any additional balance above the safety net will increase the maximum withdrawal amount by an equivalent amount. If, for example, your balance is $500 above the safety net, you can withdraw $500 + $500 = $1,000.

| Size | Safety Net |

|---|---|

| $25k | $26,600 |

| $50k | $52,600 |

| $75k | $77,850 |

| $100k | $103,100 |

| $150k | $155,100 |

| $250k | $256,600 |

| $300k | $307,600 |

| $100k Static | $102,600 |

Maximum withdrawal

There is a maximum withdrawal amount depending on the account size. This limit only applies to the first 5 withdrawals or until a live account is created. After this, the total winnings can be withdrawn without restriction.

| Size | Maximum withdrawal |

|---|---|

| $25k | $1500 |

| $50k | $2000 |

| $75k | $2250 |

| $100k | $2500 |

| $150k | $2750 |

| $250k | $3000 |

| $300k | $3500 |

| $100k Static | $1000 |

Restricted Countries

Afghanistan, Jordan, Republic of the Congo, Algeria, Kazakhstan, Réunion, Azerbaijan, Kenya, Russia, Bahrain, Kosovo, Rwanda, Bangladesh, Kuwait, Saint Pierre and Miquelon, Belarus, Latvia, Saudi Arabia, Benin, Lebanon, Senegal, Brunei, Lesotho, Serbia, Burkina Faso, Madagascar, Somalia, Cameroon, Maldives, South Africa, Central African Republic, Mauritania, Sri Lanka, Chad, Mauritius, Tanzania, China, Mongolia, Togo, Congo, Morocco, Trinidad and Tobago, Ivory Coast, Mozambique, Tunisia, Cuba, Namibia, Turkey, Curaçao, Nepal, Uganda, Cyprus, New Caledonia, Ukraine, Egypt, Nicaragua, Uzbekistan, Gabon, Niger, Venezuela, Grenada, Nigeria, Vietnam, Haiti, Oman, Western Sahara, Indonesia, Occupied Palestinian Territory, Yemen, Iran, Pakistan, Zambia, Iraq, Qatar, Zimbabwe, Jersey and Republic of Moldova.

Opportunities and promotions

Apex is a company that runs promotions regularly. These promotions often offer huge discounts. Around 80% off trial subscriptions, plus other benefits such as reduced reset prices and lifetime activation.

We can, therefore, consider the actual prices to be those obtained after applying the promotions, and not those initially shown on the website or documentation.

To always get the current Apex promotion, access the website from this link, or use my referral code at checkout.

HIZDRMOV

My opinion on Apex Trader Funding

Apex is a funding company I’ve never used, due to my specific needs as a trader. That said, my feeling after thoroughly analyzing it is quite positive. Similarly, after researching groups and social media, I’ve found that traders’ experience is mostly positive, with the exception of those who have had specific issues or didn’t understand what the company is all about.

In short, it’s a prop firm that looks for futures day traders who trade consistently and methodically. If you’re that type of trader, I don’t think you’ll have any problems.

What I like the most

- They make it quite clear what can and cannot be done.

- Prices are good after using the promotions, which are practically constant.

- The distribution of benefits is very good.

- Withdrawal management is methodical and has clear rules.

- They have no problem with aggressive strategies when it comes to passing the test.

- It allows up to 20 funded accounts, as well as copying trades between them. A truly skilled trader can manage huge amounts with this model.

What I like least

- You can only do day trading, since you have to close positions every day.

- The various parameters, such as account size, number of contracts, and maximum drawdown, vary greatly proportionally between accounts. I don’t fully understand the logic behind this, and it would confuse me when making a choice.

- The fact that promotions are constant makes them pointless. I think this type of marketing ends up having a negative effect on the user. It does for me.

Don't miss anything!

Get the latest news, exclusive promotions and funded trading analysis directly in your inbox